2024 Guarantee Trust Life Insurance Review

Are you wondering who Guarantee Trust Life Insurance Company is? Well, they are one of the best life insurance carriers for burial insurance when it comes to seniors with moderate health conditions. In this Guarantee Trust Life Insurance Reviews, we will cover everything about this company when it comes to you making an informed decision.

If you are a senior with moderate health conditions like COPD & CHF together or had recent heart surgeries within 1 year then Guarantee Trust Life burial insurance is the perfect plan for you and in this article we will explain why.

Making sure your family is not left with the financial burden of your final expenses when you pass away is a top priority. If you have health conditions that are getting you disqualified from life insurance companies this presents even more of a problem.

All of these reasons point towards the fact that Guarantee Trust Life may be the perfect company for you and your unique needs.

Table of contents

- What is Guarantee Trust Life?

- How long has Guarantee Trust been in Business?

- Guarantee Trust Life Insurance Products & Features

- Where is Guarantee Trust life Located?

- Guarantee Trust Life BBB Rating

- Guarantee Trust Life Insurance Company AM Best Rating

- Is Guarantee Trust Life a Good Company?

- Frequently Asked Questions

What is Guarantee Trust Life?

They are an insurance company that offers life insurance and medicare supplement insurance.

Company Info:

- Address: 1275 Milwaukee Ave, Glenview, IL 60025

- Phone: (847) 699-0600

- Website: gtlic.com

How long has Guarantee Trust been in Business?

They have been in business since 1936 and have been providing excellent customer service and assisting individuals with getting affordable insurance coverage ever since.

Being in business for so long proves their solid reputation and financial strength. This is why GTL is one of our highest recommended carriers for seniors with moderate health conditions. They have been in business for so long there is no way they are going anywhere any time soon.

It is important to work with companies that have been in business for a long time and maintain such a solid reputation because this proves how dependable they are.

Guarantee Trust Life Insurance Products & Features

As we mentioned before in this Guarantee Trust Life Insurance Review, they offer 2 products.

- Medicare Supplement

- Whole Life Insurance is also known as Final Expense Insurance

We are going to focus on their final expense insurance also known as burial insurance. The thing that makes their product so great is its underwriting.

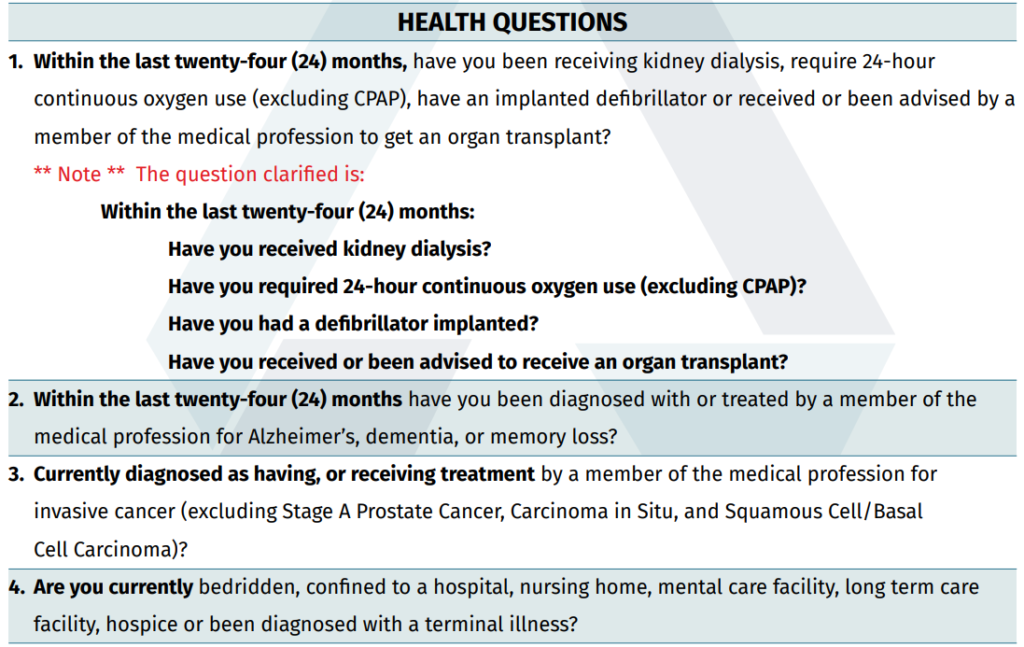

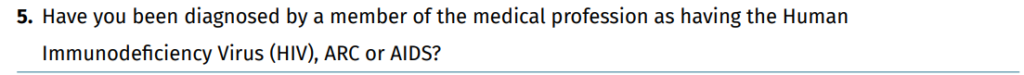

They will not make you take a medical exam to qualify and they only have 5 health questions on their application. This is for their Heritage Plan, below you will see the health questions on their application.

Guarantee Trust Life Heritage Plan

It is important for you to have a visual for a guarantee trust life review so you can better understand their products. Below is a table outlining the final expense life insurance product from guarantee trust life which is called their Heritage Plan.

| Feature | Description |

|---|---|

| Guaranteed Premiums | Premiums never increase as long as coverage is in force |

| Guaranteed Benefits | Coverage will not change or can be canceled as long as premiums are paid |

| Easy Application | No medical exam, just answer health questions & health history check |

| Graded Death Benefit | Death benefit payout varies based on policy year: 5% of premiums paid plus face amount in year 1, 50% of face amount in year 2, and 100% of face amount in year 3 |

| Cash Value | Policy builds cash value over time |

| Heritage Plan Highlights | -Issue Ages: 40-90 years – Death Benefit Amounts: $2,500 to $25,000 – Accidental Death Benefit: Full face amount paid for accidental deaths in the first 2 years |

| Death Benefit | Paid to the beneficiary upon the insured’s death as specified in the policy |

| Accidental Death Benefit | Full face amount paid for deaths resulting from accidental bodily injuries in the first 2 years of the policy, subject to certain conditions |

| Accidental Death Benefit Exclusions | Specifies exclusions for accidental deaths caused by specific circumstances (e.g., disease, suicide, war, illegal activities, intoxication, participating in certain sports or activities). |

| Suicide Exclusion | Limits liability in the event of suicide within 2 years of the policy effective date or reinstatement date |

| Graded Death Benefit Whole Life Insurance | This specific type of whole life insurance provides a graded death benefit payout structure. It is issued by Guarantee Trust Life Insurance Company with availability and details varying by state |

Health Q’s

Now not only is this plan easy to qualify for but also it is one of the best Graded policies on the market because it does not put you into a full 2 year waiting period for the full death benefit.

Instead, if you die within year 1 of having this policy your beneficiary will receive the premiums you paid plus 5% which is pretty standard but in year 2 your beneficiary will receive 50% of the face amount.

In year 3 of having the policy, the full face amount is paid to your beneficiary. The thing that makes this such a great plan is the fact that other Graded policies will make you wait a full 2 years to receive the face amount.

Before your 2 years are up if you die within that time your beneficiary only gets the premiums plus 10% in most cases.

Accidental Death

Now if you die from an accident with a Guarantee Trust Life policy they will pay the full face amount regardless of the waiting period. This is what makes GTL far more superior to any other Graded policy on the market.

To see pricing for this plan and speak with one of our agents to enroll, fill out the form to your right.

Where is Guarantee Trust life Located?

They are located at the following address 1275 Milwaukee Ave, Glenview, IL 60025.

This is very close to the Kennicott’s Grove Nature Preserve.

Guarantee Trust Life BBB Rating

This company has an A+ rating with the BBB.

Now Guarantee Trust Life is not accredited with the better business bureau but they still maintain that good rating.

Guarantee Trust Life Insurance Company AM Best Rating

Their AM Best Rating is A-(Excellent) for good financial strength. This is a high score for such a strong long-standing company this is how you know guarantee trust life is a solid life insurance company.

Is Guarantee Trust Life a Good Company?

Yes in this guarantee trust life insurance reviews we conclude that they are a great company for seniors with moderate health conditions that cannot find coverage anywhere else.

If you have moderate health conditions and do not want to leave your family with a huge bill when you pass away contact us immediately and our agents will help you enroll.

Fill out the form to your right to get started.

Frequently Asked Questions

Is guarantee trust life insurance co. legit?

Yes, guarantee trust life insurance is a legitimate life insurance company. They have one of the best modified life insurance products for final expense on the market for seniors.