Burial Insurance With Congestive Heart Failure: Full Guide

If you are wondering if you can get burial insurance with Congestive Heart Failure you are in the right place. The answer is yes you can get burial insurance with congestive heart failure in fact Prosperity Life can offer final expense insurance with no waiting periods if you have Congestive Heart Failure from over 2 years ago with no complications.

Now other types of life insurance(term life, universal life etc.) are going to deny you coverage. Other types of life insurance for congestive heart failure will not accept an applicant with this condition period. Your only option if you have this condition is going to be final expense life insurance.

According to www.emoryhealthcare.org

Nearly 5 million Americans are living with congestive heart failure, each year approximately 550,000 new cases are diagnosed.

In this guide, we will go over the fact that not many FE agents know Prosperity will accept this condition, why prosperity life is the best life insurance company for Congestive Heart Failure, Features & Benefits and how to apply.

Table of contents

- Burial Insurance for Congestive Heart Failure Secret to No Waiting Periods

- Life Insurance for Congestive Heart Failure Term & Universal

- Burial Insurance Congestive Heart Failure No Medical Exam

- Prosperity Life Best Life Insurance Company for Congestive Heart Failure

- Best Burial Insurance Plan Option after Diagnosis?

- Best Burial Insurance Features?

- How Much Burial Insurance do I need?

- How to Apply for Burial Insurance Congestive Heart Failure?

Burial Insurance for Congestive Heart Failure Secret to No Waiting Periods

We are going to tell you a secret that not many life insurance agents know in this industry which is what makes us superior field underwriters for life insurance for congestive heart failure.

The secret is you do not have to get a guaranteed issue life insurance policy for burial insurance. You can get life insurance for congestive heart failure with no waiting periods.

Other agents out there are literally taught that for final expense life insurance for congestive heart failure consumers can only get guaranteed issue life insurance. This is not true we know how to get you approved for final expense whole life insurance that has no waiting period.

That is the way we are trained at this agency to help our clients get life insurance for congestive heart failure preferably with no waiting periods.

Now, this is not always guaranteed considering other factors that we will get into throughout this article but the main point is there is a strong chance you can get whole life insurance without a waiting period if you have congestive heart failure.

Life Insurance for Congestive Heart Failure Term & Universal

We are going to be very blunt and straightforward about term life and universal life policies. You will be declined for both term and universal whole life policies if you have Congestive Heart Failure. CHF is a condition that never goes away.

This means getting traditional life insurance for congestive heart failure that requires a medical exam(term & universal) will result in a decline with any company. That is why your only option when it comes to life insurance for congestive heart failure is going to be final expense life insurance.

Burial Insurance Congestive Heart Failure No Medical Exam

Unlike term life insurance, burial insurance companies use simplified underwriting to qualify clients.

You will answer health questions on their application concerning medical conditions. They will look at your medical records through the Medical Information Bureau Health Report and your prescriptions.

That is their whole process, the life insurance companies do not require a medical exam. They will not send someone to your home to draw blood and perform physical tests.

The biggest deciding factor in getting life insurance with heart conditions is time.

The longer you have managed your condition and have not had any further issues the more favorable a carrier looks at your health condition. If it has been 2 years since your diagnosis and you have had no issues since then with prescriptions being minimal your chances of approval are extremely high.

This is why our insurance agents when speaking with you at the time of the application will ask you questions like:

“Have you been diagnosed with Congestive Heart Failure in the Last 2 years?”

Our independent agents would ask follow up questions as well like:

“What Type of Prescriptions do they have you taking?”

This is all very important information so they can place you with the right carrier for approval. Once they have a good idea of your health they will know exactly which carrier to go to when applying for life insurance.

Prosperity Life Best Life Insurance Company for Congestive Heart Failure

If you have congestive heart failure diagnosed over 2 years ago with barely any medications and is well maintained then our agents can get you immediate coverage with our carrier Prosperity Life. This is our niche carrier for heart conditions diagnosed over 2 years ago and CHF is no different.

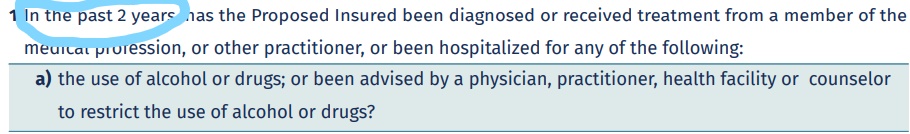

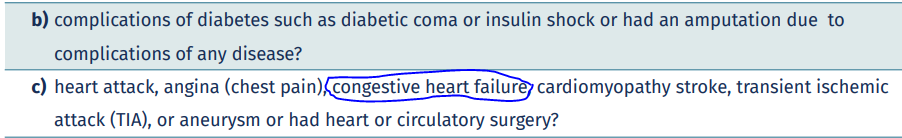

Here is their health question below if you can answer “no” to this then Prosperity is your best option.

Best Burial Insurance Plan Option after Diagnosis?

Above all, if you have been recently diagnosed with Congestive Heart Failure in the last year, time is of the essence.

Congestive Heart Failure is not a condition that is expected to go away. You will have it your entire life and the reality is your life expectancy is shortened significantly.

As we stated earlier, time plays a big factor.

Congestive Heart Failure diagnosed over 2 years ago with minimal medications

Option: Strong Chance of approval for Level Day One Coverage

Congestive Heart Failure Diagnosed within the last Year

Option: Modified Death Benefit

Option: Guaranteed Issue Life Insurance

Level Plan

The longer you have lived with your condition and managed it, the more the carrier considers you a low-risk client. This makes you eligible for level death benefits which means the policy will pay out the day you are covered if death occurs.

Modified Plan

If you have been recently diagnosed with CHF you are looked at as a high-risk applicant which makes you eligible for either a Modified Death Benefit which pays 110% of premiums if death occurs in year 1 and 231% of premiums if death occurs in year 2. After 2 years the full death benefit is paid.

Guaranteed Issue Plan

With a recent CHF diagnosis GI may be your only option in some cases. This plan pays 110% of premiums if death occurs within the first 2 years. After 2 years the full death benefit is paid.

If you have had a recent diagnosis then getting a 2-year waiting period started now is your best option.

Best Burial Insurance Features?

The best policy will have the following features:

- A Rate Lock

- Death Benefit Never Decreases

- Death Benefit is Tax-free to the Beneficiary

A burial insurance policy should be a Whole Life Final Expense Life Insurance Policy with those above features.

There are many carriers typically featured in TV advertisements that do not offer good policies. They will typically offer policies with a premium that increases over time.

In addition, they will offer policies with a decreasing death benefit. We have had clients tell our agents about a policy they bought that had a face amount of $20,000 5 years ago and now it is only $8,000!

Anytime you see phrases on TV commercials saying things like:

“No Health Questions Asked!”

“3 Simple Health Questions and everyone is approved!”

“Coverage starting at only $9.95!”

You should be very skeptical. These are red flags that these companies are taking a “One Size fits All.” approach to their clients. This results in a massive disservice to you and your family.

Other questions to ask would be:

“Has the insurance company been in business for over 50+ years?”

“Are they A-rated?”

An insurance company that has been in business for over 50 years and maintains an A – rating is the best reputation a company can have.

This proves they are not going out of business and that they have maintained a high level of customer satisfaction.

Here at ParamountQuote we represent these top major carriers and know their niches to secure you the best rate for burial insurance with congestive heart failure.

How Much Burial Insurance do I need?

This depends on what type of service you or your family want when your time comes.

Burial Service

The average for burial typically falls between $8,000 – $12,000 not counting inflation. Counting inflation this can be upwards of $18,000. This is why when planning your funeral expenses always take inflation into account. For an accurate price list, you can visit your local funeral home.

Cremation Service

The average for a cremation falls between $3,000 – $5,000 not counting inflation. Counting inflation this can be upwards of $10,000. For an accurate price list, you can visit a local funeral home.

The total amount including inflation should be the amount of coverage you apply for and purchase.

How to Apply for Burial Insurance Congestive Heart Failure?

Getting started is simple.

First, fill out the quote form to your right. You will see carriers and pricing.

After filling out the form with some basic information one of our licensed agents will reach out to you via phone call.

Once you are on the phone with them they will begin the field underwriting process.

They will confirm some basic information and ask a few health questions and determine your rate class.

At that point, the agent will begin the enrollment process. There are 2 different methods for enrollment depending on the carrier selected.

Voice Signature – A voice sign between you, the agent, and the insurance carrier or just you and the agent. You simply apply your voice signature to all of the necessary forms on the application and an instant decision is reached.

E-mail Signature – The agent will send you a DocuSign email to sign for your application. You simply follow the prompts and at that point, a decision is reached.

Both methods can be done in under 30 minutes. At that point, the carrier will give you an instant decision, no waiting weeks to hear back about your approval it is done within minutes.

We pride ourselves on our quick, thorough, and easy process.

Fill out the form to your right to speak with one of our agents and get started.