How to Get The Best Burial Insurance with No Waiting Period

If you are looking to understand & buy burial insurance with no waiting period you are in the right place. A burial policy(final expense policy) with no waiting period is simplified issue whole life insurance.

This means the policy never expires and is designed to cover burial, cremation, funeral and any other end of life expenses when you die. You are covered for the full death benefit of the policy the moment you make your first monthly premium payment for the plan.

It provides a fast lump-sum death benefit payout to your family(beneficiary) to pay for your final expenses. It builds cash value, premiums never increase, policy benefit never decreases.

There are no medical exams required to qualify only health questions on the life insurance application, medical history & prescription checks.

You apply & buy burial insurance with no waiting period by working with a licensed life insurance agent or broker in your state.

Table of contents

- Burial Insurance with No Waiting Period & How it Works

- Is there a Waiting Period for Burial Insurance?

- Buy Burial Insurance with No Waiting Period

- Does Final Expense Insurance Have a Waiting Period?

- Best Funeral Cover for Parents with No Waiting Period

- Burial Insurance Eligibility for Non Waiting Period or Waiting Period

- The Best Burial Insurance Companies with No Waiting Period

- What Life Insurance Starts Immediately?

- Best Life Insurance with no Waiting Period

- What Burial policy requires a Medical Exam?

- Guaranteed Acceptance Life Insurance

- Burial Insurance for Seniors

- Best Funeral Insurance Plan

- Burial Insurance No Medical Exam

- Burial Insurance Quotes with No Waiting Period for Ages 19 – 91

- Choose ParamountQuote for Burial Insurance with no Waiting Period

Burial Insurance with No Waiting Period & How it Works

Burial insurance with no waiting period is typically referred to as level plans or immediate coverage plans. It is a permanent whole life insurance plan that never expires.

The policy pays out 100% of the death benefit if death occurs during the first 2 years.

You are covered for the full death benefit the day you make your first monthly premium payment and the policy activates.

It has level premiums(premiums never increase) and level death benefits(death benefit never decreases).

Coverage amounts range between $2,000 – $50,000 in life insurance coverage. These policies are designed to cover burial, funeral and any other end of life costs.

The policy builds cash value over time as you pay your premiums. It pays a tax-free death benefit to your beneficiary when you die that they can use to pay the funeral costs

Any money left over after burial expenses are paid is theirs to keep and do as they wish with it.

Important: The median cost of a burial is $7,898 according to NFDA statistics. We recommend purchasing at least $10,000 in whole life coverage to protect your family from the funeral bill.

Is there a Waiting Period for Burial Insurance?

That depends on a few things. The first thing to understand is underwriting risk assessment.

Insurance is the transference of risk meaning the insurance company is taking the risk for your final expenses. This is why in many cases you will see, hear, or maybe even have undergone medical exam life insurance.

Always remember burial insurance , life insurance, and final expense insurance are all the same thing just with different marketing terms.

– Tim Connon

So if you are in good health there is no waiting period for burial insurance but if you are in poor health there will be a waiting period for burial insurance.

The simplified underwriting makes getting final expense insurance with no waiting period easier even if you have moderate health conditions.

How Long Does it Take for Burial Insurance to Take Effect?

A burial insurance policy with no waiting period takes effect as soon as you make your first insurance premium payment on the date that you specified in the application process when you sign up.

Now if you have medical conditions that are extremely severe you may wind up with a waiting period.

If that happens the burial insurance will not take effect until you have gotten through the 2-year waiting period.

A Real Burial policy with no Waiting Period

A lot of different life insurance options and products are marketed to seniors as life insurance for seniors no waiting period.

Now this no waiting period life insurance for seniors can be term insurance which terminates after a length of time. This is why you need to work with the right life insurance agents like us to get full coverage.

The underwriting process for final expense insurance or funeral insurance is simple. You answer the health questions they check your Medical Information and prescriptions.

If everything lines up you are approved instantly right over the phone.

When working with an independent agent like use they will walk you through each of the medical questions to help you better understand them.

Buy Burial Insurance with No Waiting Period

Term Insurance with a Medical Exam is not Burial Insurance

They send a paramedic out to your home and draw blood and also run some physical tests for health issues or any chronic illness ask health questions to determine whether or not you are a high-risk case.

Then after all of that, you are waiting in many cases a month or longer to get approval!

When it comes to final expense insurance no waiting period being in good health is a key factor to avoiding a 2 year waiting period graded policy.

This is why if you have moderate health conditions term life insurance is not a good option for you because they will want you to do a medical exam.

If you are in extremely poor health or terminally ill a guaranteed issue policy may be your only option for senior life insurance.

Remember the best funeral insurance with no waiting period is going to be final expense life insurance most notably simplified issue whole life insurance.

There is no such thing as Guaranteed Acceptance life insurance No Waiting Period

Now a GI policy is still a good product because acceptance is guaranteed, you may have slightly higher insurance costs but once your past the 2-year waiting period your beneficiary receives the benefits.

In many cases depending on what company you choose out of the companies offered if you die from accidental death the full benefit is paid regardless of the 2-year waiting period.

With burial insurance these are simplified issue plans meaning approval is done in 30 minutes! Not 1 or even 12 months! These plans are designed for fast approval as well as a fast payout to cover funeral expenses.

Above all, this is where working with our highly trained agents comes in. We pride ourselves on our specialized training to help clients that may have a few health conditions get coverage without a waiting period.

We know the underwriting niches for these companies that guarantee the best coverage and rate for you and your unique health profile. This is how we find your burial insurance with no waiting period.

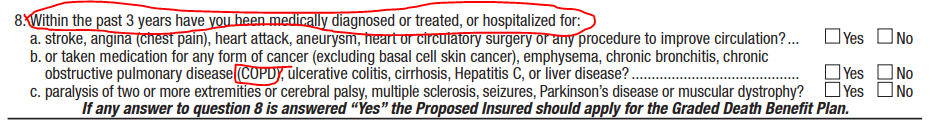

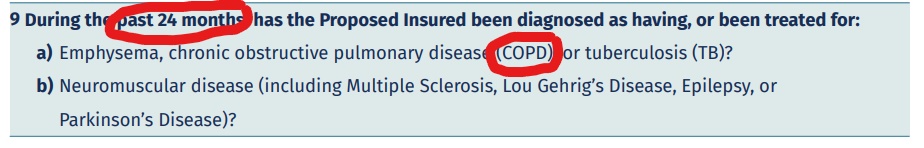

In many cases, we have helped clients with conditions such as COPD and CHF get coverage with no waiting period! it is possible!

These companies see you as a person not just a list of health conditions, it all comes down to how controlled some of your conditions are and the severity of them.

A person with mild COPD that just has a nebulizer is looked at far differently by certain carriers than a person who has severe COPD and is currently on oxygen tanks to assist in breathing.

A person with mild COPD diagnosed years ago with a nebulizer has a very strong chance at getting approved with no waiting period whereas someone with COPD on oxygen tanks has only 1 option which is guaranteed issue life insurance.

So if you are classified into a high-risk category the carrier may approve you for a waiting period policy or flat out deny your application completely.

If you are in a low-risk category then you would be approved for burial insurance with no waiting period.

Does Final Expense Insurance Have a Waiting Period?

Yes and no, depending on your health funeral insurance will have an immediate benefit, partial waiting period, or full 2-year waiting period.

If you have current cancer that is being treated this means your final expense insurance will have a waiting period.

If you had cancer over 2 years ago and have been healthy since then with no medications this means you can qualify for no waiting period.

It all depends on your health when it comes to funeral insurance with no waiting period.

Now that being said not all life insurance companies ask the same health questions on their applications or look back the same amount of years on the condition.

This means if you have COPD that was diagnosed over 2 years ago both Aetna and Royal Neighbors of America can issue immediate coverage to you as long as there are no other health conditions that could change this.

If you have COPD and Congestive Heart Failure you will always have a 2-year waiting period with your policy. These 2 conditions together mean you can only get a guaranteed issue life insurance policy like AIG or Gerber life insurance.

Your health conditions determine which company will provide the cheapest rates for you. Now generally the cheapest funeral insurance with no waiting period is from Mutual of Omaha.

They have the lowest rates out of most other life insurance companies for final expense life insurance with no waiting period.

Best Funeral Cover for Parents with No Waiting Period

Funeral cover for parents benefits them by providing coverage immediately. If your parent passes away suddenly even though they just purchased the policy the funeral expenses will be covered.

This is why final expense insurance with no waiting period is the best coverage for senior parents.

If you’re parents are on a fixed income this is the best option for them. In addition to this you can also purchase funeral coverage for your parents.

Burial Insurance Eligibility for Non Waiting Period or Waiting Period

Below is our comprehensive table showing which conditions are can qualify for burial insurance with no waiting and burial insurance with a waiting period.

| Health Condition | Day One Coverage | Waiting Period | Best Company |

|---|---|---|---|

| ADL’s(Assistance of Daily Living Eating, Dressing, Toileting, Bathing) | Yes | No |  |

| AIDS & HIV | No | Yes |  |

| ALS | No | Yes |  |

| Alcohol Abuse | Yes | No |  |

| Alzheimers & Dementia | No | Yes |  |

| Amputation Caused by Accident (No ADLS Needed) | Yes | No |  |

| Amputation Caused by Accident(ADL’s Needed) | No | Yes |  |

| Amputation Caused by Diabetes or Disease(No ADL’s Needed) | Yes | No | |

| Amputation Caused by Diabetes or Disease(ADL’s Needed) | No | Yes |  |

| Aneurysm | Yes | No |  |

| Angina | Yes | No |  |

| Angioplasty | Yes | No |  |

| Assisted Living Facility | Yes | No |  |

| Asthma | Yes | No |  |

| AFIB (Atrial Fibrillation) | Yes | No |  |

| Autism | Yes | No | |

| Brain Tumer(Non Cancerous) | Yes | No |  |

| Bipolar Disorder | Yes | No |  |

| Brain Tumor(Cancerous) | Yes | No |  |

| Bronchitis (Chronic) | Yes | No |  |

| Cancer-Must have occured and been cured over 2 yeas ago with no further complications or medications | Yes | No |  |

| Coronary Bypass Surgery | Yes | No |  |

| Cardiomyopathy | Yes | No |  |

| Cerebral Palsy | Yes | No |  |

| COPD Chronic Obstructive Pulmonary Disease | Yes | No |  |

| Circulatory Surgery | Yes | No |  |

| Cirrhosis | Yes | No |  |

| Congestive Heart Failure | Yes | No | |

| Cystic Fibrosis | Yes | No | |

| Defibrillator | Yes | No |  |

| Depression | Yes | No |  |

| Diabetes(Without Complications) | Yes | No |  |

| Diabetes(With Complications) | Yes | No |  |

| Dialysis | No | Yes |  |

| Down Syndrome | Yes | No | SBLI |

| Drug & Alcohol Abuse | Yes | No |  |

| Emphysema | Yes | No |  |

| Heart Attack | Yes | No |  |

| Heart Disease | Yes | No |  |

| Obesity & Under Weight | Yes | No |  |

| Hepatitis C | Yes | No |  |

| Hospitlization(Current) | No | Yes |  |

| Huntington’s Disease | Yes | No |  |

| Kidney Disease Stage 1 – 3 | Yes | No |  |

| Kidney Disease Stage 4 – 5 | Yes | No |  |

| Lupus (Systemic) | Yes | No |  |

| Multiple Sclerosis | Yes | No | |

| Muscular Dystrophy | Yes | No |  |

| Organ Transplant | No | Yes |  |

| Oxygen Tanks | No | Yes |  |

| Oxygen Concentrator | Yes | No |  |

| Pacemaker Implant | Yes | No |  |

| Pancreatitis | Yes | No |  |

| Parkinson’s Disease | Yes | No |  |

| Pending Surgery | No | Yes |  |

| Schizophrenia | Yes | No |  |

| Scleroderma | Yes | No |  |

| Seizures | Yes | No |  |

| Sickle Cell Anemia | Yes | No |  |

| Sleep Apnea | Yes | No |  |

| Stroke | Yes | No |  |

| Stent | Yes | No |  |

| TIA Mini Stroke | Yes | No |  |

| Tumor Cancerous | No | Yes |  |

| Tumor Non-Cancerous | Yes | No |  |

| Ulcerative Colitis | Yes | No |  |

The bottom line here is no matter what you cannot be denied coverage.

Health Conditions That Only Qualify for Guaranteed Issue Plan(Waiting Period)

If you have any of the following conditions in the table below you will never be able to get a burial policy with no waiting period. You will have no other life insurance choices except to apply for guaranteed issue life insurance.

| Health Condition | Guaranteed Issue Life Insurance Only |

|---|---|

| Kidney Dialysis | Yes |

| Use of Oxygen Tanks (Does not Include Oxygen Concentrator or CPAP) | Yes |

| Organ Transplant | Yes |

| Alzheimers & Dementia | Yes |

| Current Cancer or Cancer Within 12 Months | Yes |

| Nursing Home Confinement, Hospital, Mental Health Facility, Hospice | Yes |

| Terminal Illness | Yes |

| AIDS ARC or HIV | Yes |

Those conditions listed on the table definitely show that you cannot get funeral insurance with no waiting period and will have to opt for a guaranteed issue plan.

The Best Burial Insurance Companies with No Waiting Period

Different burial insurance companies accept and deny different health impairments.

Now the companies below have extremely liberal underwriting and between all of these companies is how we guarantee our clients a 90% approval rating for final expense insurance with no waiting period.

Our best burial insurance with no waiting period companies for this to name a few would be:

Prosperity Life

Prosperity new vista is very accepting of applicants with heart conditions depending on time line, medications and severity. This would be the best company to apply with for no waiting period burial insurance.

| Age Eligibility | Policy Brochure | |

★★★★★ | 55-80 | Brochure |

| Policy Features & Benefits | Type of Policy: Whole Life(Lifetime Coverage) | Waiting Period: Graded & Modified Plans(yes) Level Plan(no) |

| Available States: All Except SC,SD,CT,MT,NY,ND | Level Premiums(Premiums Never Increase) | |

| Cash Value Builds in Policy | No Medical Exam Required | |

| Death Benefit Amounts: $5,000-$35,000 | Level Death Benefit(Death Benefit Never Decreases) | |

| Accelerated Death Benefit Rider | Allows the insured to access the policy death benefit in the event of a terminal illness, providing funds for various needs such as living expenses or early funeral expenses. | |

| Accidental Death Benefit Rider | Doubles the policy payout if death is a result of an accident, operating similarly to other accidental riders. | |

Mutual of Omaha

Mutual of Omaha funeral insurance is perfect for seniors in more optimal health. Conditions such as controlled diabetes etc. are what they will accept and issue coverage with no waiting periods. They also offer the cheapest burial insurance with no waiting period rates for seniors.

| Age Eligibility | Policy Brochure |

★★★★★ | 45-85 | Brochure |

| Policy Features & Benefits | Type of Policy: Whole Life(Lifetime Coverage) | Waiting Period: Graded Plan(yes) Level Plan(no) |

| Death Benefit Amounts: $2,000-$50,000 | Level Death Benefit(Death Benefit Never Decreases) | |

| Available States: All Except NY | Level Premiums(Premiums Never Increase) | |

| Cash Value Builds in Policy | No Medical Exams Required | |

| Accelerated Death Benefit Rider | Allows the insured to access a portion of the policy’s death benefit while alive for various needs such as medical bills, living expenses, and funeral expenses. | |

| Eligibility | Applicable when the insured is diagnosed with a terminal illness (12 months to live) or has been confined to a nursing home for more than 90 days without the expectation of leaving. | |

| Inclusion | Automatically included in the policy at no extra cost. | |

| Accidental Death Benefit Rider | Provides an extra death benefit equal to the policy’s death benefit in case of death resulting from an accident. | |

| Inclusion | Requires an additional charge to be added to the policy. | |

American Amicable

American Amicable’s burial coverage is also very liberal in their underwriting. This means applicants with even moderate health conditions can get approved for no waiting periods. They offer the cheapest burial insurance with no waiting period smoker rates on the market.

If you are a smoker looking to save money on final expense life insurance premiums this is the best policy for you.

| Age Eligibility | Policy Brochure |

★ ★ ★ ★ ★ | 50-85 | Brochure |

| Policy Features & Benefits | Type of Policy: Whole Life(Lifetime Coverage) | Waiting Period: Immediate Benefit Plan(No) Graded & ROP Plans(Yes) |

| Available States: All Except NY | Level Premiums(Premiums Never Increase) | |

| Cash Value Builds in Policy | No Medical Exams Required | |

| Death Benefit Amounts: $2,000-$50,000 | Level Death Benefit(Death Benefit Never Decreases) | |

| Terminal Ilness Accelerated Death Benefit Rider | Allows the insured diagnosed with a terminal illness to use the entire policy death benefit (100%) for any purpose. If you have a $10,000 policy and are diagnosed with a terminal illness, you can access the full $10,000 for various needs. | |

| Accelerated Death Benefit Rider Confined Care | Provides 5% of the death benefit in monthly payments if the insured is confined to a nursing home 30 days after the policy starts. Can be used for monthly bills or other smaller expenses. | |

| Grandchild Rider | Offers $5,000 life insurance coverage per unit for a grandchild or great grandchild, with a maximum of 2 units totaling $10,000 in coverage. Costs an additional $1.00 on the monthly policy premium per unit for each grandchild. | |

| Children’s Insurance Agreement | Provides up to $6,000 in coverage for each child below age 25. Can be converted to a whole life or endowment policy when the child is over 25. Allows coverage up to 5 times the coverage amount, totaling $30,000, without demonstrating insurability. | |

| Nursing Home Waiver of Premium Rider | Waives premium payments on the policy if the insured is confined to a nursing home for over 90 days, making the insurance essentially free. | |

| Accidental Death Benefit Rider | Doubles the death benefit payout if the insured or loved one dies from an accident, with no additional cost to be added. | |

Transamerica

Transamerica funeral coverage is also very cheap on their rates for seniors. They also do not have any height and weight requirements which means they are perfect for getting the best burial insurance with no waiting period for obese persons.

| Age Eligibility | Policy Brochure |

★★★★★ | 45-85 | Brochure |

| Policy Features & Benefits | Type of Policy: Whole Life(Lifetime Coverage) | Waiting Period: Graded Plan(yes) Preferred & Standard Plans(no) |

| Available States: All States | Level Premiums(Premiums Never Increase) | |

| Cash Value Builds in Policy | No Medical Exams Required | |

| Death Benefit Amounts: $2,000-$50,000 | Level Death Benefit(Death Benefit Never Decreases) | |

| Accelerated Death Benefit Rider & Nursing Home Confinement | Pays the full death benefit if the insured experiences a terminal illness or is confined to a nursing home. | |

| Accidental Death Benefit Rider | Pays an additional coverage amount equal to the face amount for ages 18-70 in the event of death due to an accident. The policy payout doubles, e.g., a $15,000 policy becomes a $30,000 payout to the beneficiary. | |

| Children & Grandchildren Benefit Rider | Offers coverage between $1,000 – $5,000 for children aged 15 days – 18 years, with a maximum of 9 children covered. The coverage can be converted when the child becomes an adult. | |

Aetna

Aetna’s funeral policy is how to get the best burial insurance with no waiting period for seniors with breathing conditions. If you have COPD diagnosed over 2 years with no complications and minimal prescriptions they can offer no waiting periods.

| Age Eligibility | Policy Brochure |

★★★★★ | 40-89(Preferred & Standard Plans) 40-75(Modified Plan) | Brochure |

| Policy Features & Benefits | Type of Policy: Whole Life (Lifetime Coverage) | Waiting Period: Preferred & Standard Plan(No) Modified Plan(Yes) |

| Available States: All Except NY | Level Premiums (Premiums Never Increase) |

|

| Cash Value Builds in Policy | No Medical Exams Required | |

| Death Benefit Amounts: $2,000-$50,000 | Level Death Benefit (Death Benefit Never Decreases) |

|

| Accelerated Death Benefit Rider | Allows the insured diagnosed with terminal, critical, or chronic illness with an expected death within 12 months to access 50% of the policy death benefit for various purposes such as bills or funeral planning. | |

| Accidental Death Benefit Rider | Pays out an amount equal to the policy death benefit for accidental death if the insured is between 40 and 70 years old. | |

| Children’s Term Insurance Rider | Children and grandchildren aged 30 days to under 18 years old can be covered for amounts ranging from $2,500 to $10,000 each. The policy can be converted to a whole life policy for the child between the ages of 22 and 25. | |

When it comes to getting the best burial insurance with no waiting understanding the drawbacks of waiting periods is important. A policy with a waiting period means your have to live 2 years before the policy pays out to your family.

So to put it simply what happens to your family if you die within those 2 years? They have no way to pay for your funeral. This is why getting the best burial insurance with no waiting period is so important.

There are no drawbacks with no waiting period policies. You are literally getting the best burial insurance with no waiting periods available on the market. Premiums are low and coverage is immediate.

Now in order to buy the best burial insurance with no waiting period you need to work with a life insurance agent/broker.

A life insurance agent should represent more than 10 companies to assist you with finding a company that will approve you depending on your health.

Different burial insurance companies approve different health conditions depending on the case. Best example of this is Aetna Accendo accepting seniors with COPD for no waiting periods.

Other companies will not accept a condition like that.

This is how an agent should be trained when selling final expense life insurance with no waiting period.

Your health profile and their level of training should provide a perfect combination to finding you the best burial policy with no waiting periods.

A life insurance agent can help you compare different final expense life insurance with no waiting period plans.

What Life Insurance Starts Immediately?

There are 4 different types of life insurance benefit pay out’s.

Depending on your risk classification you could be put into one of these 4 categories.

- Level Benefit

- Graded Benefit

- Modified Benefit

- Guaranteed Issue

Level Benefit – Day one burial insurance with no waiting period. This is for clients who qualify in the eyes of the carrier as low risk therefore their coverage would be immediate upon approval and the first premium payment being received.

In short, this means God forbid you to pay your first premium tomorrow and you pass away the following day within 24 – 48 hours your family receives a check for the full face amount.

Graded Benefit – Typically pays 30% of the death benefit in year 1 than in year 2, it is 70% of the death benefit. After 2 years the full benefit is paid. This is for clients in a higher risk classification making this a gradual payout of death benefits.

Modified Benefit – Typically pays 110% of premiums paid into the policy in year 1 then on year 2 it will pay 231% of premiums paid. After 2 years full benefit amount is paid.

This is for clients in a much higher risk category. Within the first 2 years, no money is lost and a return on the premiums is made.

Guaranteed Issue – This is for clients in extremely poor health that do not qualify for any other plan due to their health conditions. Typically these policies pay within the first 2 years the premiums paid in plus 10% so no money is lost and a return is made as well.

After 2 years the full death benefit would be paid. In the event of a death due to an accident, the full face amount would be paid immediately regardless of the waiting period.

The level benefit is life insurance that starts immediately. With these 4 categories, each one offers great benefits for clients in different health situations and no one can be denied!

Best Life Insurance with no Waiting Period

Finding the best life insurance is always going to depend on a few things, what kind of benefits do you want? Whether it is a cremation or burial.

What is your unique health profile?

Do you have health conditions or not?

When it comes to finding the best companies a few key points to consider are:

Are they A-rated?

Have they been in business for 50+ years?

The rating and length of time in business tell you about their quality and stability. An A-rating is something that is just given to a company it is earned through doing business the right way.

The length of time proves they are not going anywhere and that they are financially stable.

More importantly:

Do their plans have a rate lock? Meaning will the monthly premium ever increase?

Will the death benefit ever decrease? Meaning will the policy value ever go down?

The best life insurance should have rates that never go up on you as long as you always make your premium payments and the death benefit should NEVER decrease as long as your policy is in force

What Burial policy requires a Medical Exam?

A burial whole life policy should never have a medical exam. They are simplified issue whole life plans that simply ask a few health questions and run a Medical Information Bureau health report and prescription check based on your Social Security number at the time of the application.

Other policies such as term and universal life require medical exams.

Guaranteed Acceptance Life Insurance

Even if you are someone who does not qualify for level coverage you can still be accepted into a policy. Years ago this was an impossibility for consumers in poor health to get any life insurance whatsoever.

In the past consumers would undergo full medical exams and physical tests to assess their risk categories.

It would be weeks or months before they ever received a confirmation if they were approved or denied. This was the case for many Americans back then and as a result of many families never received coverage.

Now anyone with any health background can receive coverage on top of all of that you can be approved in minutes not days!

If you have found yourself declined by a lot of companies in the past then guaranteed issue coverage is probably the best fit for you.

There are conditions that are knockouts for all companies and your only option would be GI. These are conditions are looked at as extremely high risk. These conditions would include.

- Oxygen tanks to assist in breathing

- Kidney Dialysis

- Nursing home or Current Hospital Confinement

- Ever had an organ transplant

- Alzheimer’s

- Dementia

- Current Internal Cancer

- Confinement to a Mental Care Facility

- AIDS

- HIV

- ARC

If you have any of those conditions then time is of the essence, The faster you start a guaranteed issue policy the faster you can finish the waiting period and provide your family with the full death benefit so they are not left with the financial burden of your funeral expenses.

It’s all about them your family and achieving your vision for them and their financial well-being. Thousands of families are left every day with funeral expenses to take care of and as a result, they take on a lot of debt.

Our best-Guaranteed Acceptance Companies would be:

- Great Western – Coverage Amounts $1,000 – $40,000

- Ages – 40 – 80

- American General – Coverage Amounts $5,000 – $25,000

- Ages – 50 – 85

Burial Insurance for Seniors

Now burial insurance is largely marketed to seniors. So yes burial insurance is for seniors between the ages of 45 – 85. Insurers offer this type of life insurance for younger consumers as well but it fits best with seniors that need help with their funeral costs that is why it is final expense insurance in the first place.

You receive a cash payout from the life insurance company that is covering you and your family will use that to cover the cost of the funeral home. It can also cover other expenses such as past-due credit card bills. Premium payments are due on this type of insurance Monthly.

Best Funeral Insurance Plan

The best funeral insurance plan is Simplified Issue Whole Life Insurance.

The reason is that this type of policy has no waiting period for the insurance payout. This means if have this policy in place and you die tomorrow, the burial insurance will be paying for final expenses. Your family will have the peace of mind they deserve knowing they will not go into debt when you die.

The Best Funeral Insurance Plan Can be Found with:

- Mutual of Omaha

- American Amicable life insurance company

- Prosperity life

- Royal Neighbors of America

- Greek Catholic Union

- Aetna

- Liberty Bankers Life

The Worst Funeral Insurance in our Opinion Can be Found with:

- Colonial Penn 995 Plan

- Globe Life

- AARP

- Fidelity Life

- Lincoln Heritage

The best funeral insurance plan is affordable burial insurance. That is Simplified Issue for Whole Life Insurance.

This is the perfect funeral cover with no waiting period because even if you are moderately healthy with a heart attack in the last 2 years or heart surgery in the last 2 years, our highly trained agents can still find you day one coverage 90% of the time.

Burial Insurance No Medical Exam

No type of burial insurance is going to make you take a medical exam. That being said they do still ask health questions on their application to see if you qualify and are approved.

This no exam burial insurance still looks at your Medical Information Bureau Health report and prescription history when the information is copied published.

They cross-reference the health report with the health questions on the application. Then they compare the prescription history to any health conditions related to their health questions.

If everything is positive you are approved.

Burial Insurance Quotes with No Waiting Period for Ages 19 – 91

Below are sample quotes for burial insurance with no waiting period. We have covered each individual age and have the companies listed that offer burial insurance with no waiting periods. These are policies that do not require a medical exam to be approved. These rates are for a $10,000 whole life insurance policy with no waiting period.

| Age | $10,000 Male Non Smoker | $10,000 Male Smoker | $10,000 Female Non Smoker | $10,000 Female Smoker |

|---|---|---|---|---|

| 19 | $12.87 | $16.59 | $12.03 | $13.74 |

| 20 | $13.19 | $17.02 | $12.13 | $15.40 |

| 21 | $13.50 | $17.46 | $12.74 | $17.02 |

| 22 | $14.17 | $18.18 | $13.06 | $17.05 |

| 23 | $14.54 | $18.51 | $13.77 | $17.08 |

| 24 | $15.43 | $19.19 | $15.16 | $17.10 |

| 25 | $15.95 | $20.00 | $15.28 | $17.39 |

| 26 | $16.28 | $20.83 | $15.40 | $17.69 |

| 27 | $16.61 | $21.75 | $15.51 | $17.95 |

| 28 | $16.92 | $22.15 | $15.61 | $18.22 |

| 29 | $17.25 | $22.54 | $15.73 | $18.48 |

| 30 | $17.57 | $23.07 | $16.09 | $19.06 |

| 31 | $17.97 | $23.60 | $16.45 | $19.66 |

| 32 | $19.84 | $24.25 | $16.79 | $20.21 |

| 33 | $20.34 | $25.00 | $17.12 | $20.75 |

| 34 | $20.93 | $25.83 | $17.45 | $21.28 |

| 35 | $21.53 | $26.59 | $17.99 | $21.89 |

| 36 | $22.14 | $27.37 | $18.54 | $22.50 |

| 37 | $22.84 | $28.18 | $19.06 | $23.08 |

| 38 | $23.54 | $29.08 | $19.55 | $23.62 |

| 39 | $24.34 | $29.87 | $20.05 | $24.18 |

| 40 | $23.13 | $30.66 | $20.70 | $24.98 |

| 41 | $23.62 | $31.43 | $19.75 | $25.80 |

| 42 | $24.11 | $32.21 | $19.93 | $26.57 |

| 43 | $24.64 | $32.93 | $20.10 | $27.30 |

| 44 | $25.18 | $33.41 | $20.38 | $28.03 |

| 45 | $25.79 | $34.00 | $20.88 | $28.80 |

| 46 | $26.43 | $34.57 | $21.43 | $29.55 |

| 47 | $27.10 | $35.17 | $22.01 | $28.06 |

| 48 | $27.71 | $35.58 | $22.33 | $28.56 |

| 49 | $27.35 | $38.27 | $21.78 | $29.22 |

| 50 | $28.29 | $39.47 | $23.56 | $30.14 |

| 51 | $29.26 | $40.77 | $24.48 | $31.06 |

| 52 | $30.31 | $42.22 | $25.09 | $32.72 |

| 53 | $31.47 | $43.83 | $25.62 | $34.54 |

| 54 | $32.77 | $45.44 | $26.26 | $38.99 |

| 55 | $34.25 | $48.12 | $27.11 | $40.85 |

| 56 | $35.88 | $52.06 | $28.20 | $42.71 |

| 57 | $37.69 | $54.25 | $29.51 | $42.30 |

| 58 | $39.64 | $56.72 | $31.70 | $43.61 |

| 59 | $40.10 | $55.60 | $31.00 | $44.50 |

| 60 | $41.84 | $56.72 | $31.70 | $43.61 |

| 61 | $43.76 | $59.64 | $32.87 | $45.19 |

| 62 | $46.41 | $63.28 | $34.51 | $47.48 |

| 63 | $49.07 | $67.72 | $36.06 | $49.78 |

| 64 | $51.22 | $69.53 | $37.72 | $52.07 |

| 65 | $53.58 | $72.72 | $39.36 | $54.36 |

| 66 | $56.48 | $76.06 | $41.01 | $56.66 |

| 67 | $59.85 | $80.53 | $43.44 | $60.22 |

| 68 | $63.18 | $84.67 | $45.86 | $63.60 |

| 69 | $66.84 | $89.65 | $48.29 | $66.09 |

| 70 | $70.79 | $94.64 | $50.81 | $70.45 |

| 71 | $73.15 | $98.31 | $53.24 | $72.18 |

| 72 | $78.81 | $103.97 | $56.20 | $75.86 |

| 73 | $83.99 | $109.94 | $58.46 | $79.74 |

| 74 | $89.46 | $116.69 | $63.55 | $84.14 |

| 75 | $94.87 | $123.65 | $67.78 | $88.66 |

| 76 | $99.97 | $132.48 | $72.41 | $94.42 |

| 77 | $107.04 | $141.32 | $78.25 | $101.63 |

| 78 | $114.13 | $150.57 | $83.51 | $108.24 |

| 79 | $122.13 | $161.81 | $88.44 | $115.15 |

| 80 | $129.52 | $171.23 | $93.41 | $125.01 |

| 81 | $139.73 | $181.75 | $98.43 | $135.14 |

| 82 | $149.95 | $192.98 | $106.21 | $147.04 |

| 83 | $160.16 | $204.65 | $113.96 | $160.56 |

| 84 | $171.02 | $219.19 | $121.31 | $170.76 |

| 85 | $181.88 | $237.28 | $128.55 | $179.58 |

| 86 | $192.74 | $257.57 | $135.90 | $192.35 |

| 87 | $236.25 | $337.32 | $171.33 | $237.32 |

| 88 | $276.68 | $353.99 | $205.98 | $253.99 |

| 89 | $317.10 | $370.65 | $240.63 | $278.99 |

| 90 | $357.53 | $378.98 | $275.28 | $303.99 |

Choose ParamountQuote for Burial Insurance with no Waiting Period

We are a national independent agency that specializes in burial insurance. We pride ourselves on our specialized training which is next to none.

Everything from the underwriting to the enrollment will be a quick process. Our agents also become your personal service agents for life!

Anytime you have a question or need help with your policy for any reason our ParamountQuote agents will be there.

We build long-lasting relationships with our clients and ensure that you have the very best coverage along with the very best future customer service that you will ever need.

Give us a call at 865-297-3732 or fill out the form to your right to speak with us and get your family protected today!

FAQ’s

what type of life insurance has no waiting period?

Simplified Issue Whole Life Insurance has no waiting period. These are policies that do not require a medical exam but they ask health questions and look at your health and prescription history to qualify you upfront.