2024 Great Western Life Insurance Review

This is going to be our full review of Great Western Life Insurance and their burial insurance products also known as whole life insurance or funeral insurance. We are going to take a deep dive into their products and history.

Here at ParamountQuote, we help clients every day get the information they need to make a properly informed decision for the right funeral plans to protect their families. It is crucial to get the right final expense plan that fits your needs and can take care of those funeral costs.

That being said Great Western is not for everyone just like other burial insurance companies are not for everyone. The reason being is that there is no perfect burial insurance company for everyone.

“It is all about what burial insurance company fits you individually.”

Tim Connon CEO & Founder of ParamountQuote

Now we are going to get right into it.

Table of contents

Great Western Life Insurance Company Background

Great Western life insurance was founded in 1983 and was started by John E Lindquist. Their headquarters are in Ogden, Utah. They have over 2.4 billion in assets which makes them a very financially stable company for final expense insurance.

Their AM Best rating is an A (Excellent) which means they are highly rated since AM Best is the leading life insurance rating company. They have also been given an A- from the Better Business Bureau.

Other details include:

- Company address – 3434 Washington Blvd., Ogden, Utah

- Great Western Life Insurance Phone Number – 1-515-247-2435

- Website – https://www.gwic.com/

Considering their financial strength and time in business this makes Great Western Insurance Company an elite among life insurance companies. This is why Great Western final expense is a perfect guaranteed issue product.

Great Western Life Insurance Reviews And Financial Ratings

The Better Business Bureau rating for Great Western life insurance is an A+ however they are not accredited with the BBB. They have a very small number of complaints and only 1 customer review as of 5/18/2023.

Great Western Whole Life Products

There are 2 products for burial insurance that Great Western offers.

Both these products are perfect for funeral expenses and making sure your family can pay the funeral home when that time comes.

Great Assurance Plan

This is their day one coverage product which means if you were to die the day after getting approved for this your family will receive the full death benefit. This means it does have medical underwriting, the good news it that means it is a funeral policy with no waiting period. In addition to this, they do not require a medical exam or anything like that.

They will not send a medical expert to your home for testing. You simply answer their health questions and depending on your Medical Information Bureau Report and prescription checks you will be approved or denied for the face amount you select.

Below is a table outlining the features and benefits for Great Western Life Insurance’s Great Assurance Plan.

| Plan | Great Assurance (First Day Coverage) |

|---|---|

| Issue Ages | 50 – 85 Years Old |

| Face Amounts | Min: $2,500, Max: $40,000 (Ages 50-80) , Max: $25,000 (Ages 81-85) |

| Benefits | Accelerated Death Benefit Rider (included at no additional cost): Terminal Illness: Life Expectancy is 12 months or less Chronic Illness cannot perform activities of daily living (ADLs) for at least 90 days or requires substantial supervision |

| Simplified Application | Answer simple health questions and no medical exam |

| Grace Period | 31 days for all states |

| Waiting Period | None |

Graded Benefit Plan

Their graded plan is for individuals with health conditions that do not qualify for their day one coverage product. Below is going to be a table outlining the features and benefits of Great Western Life Insurance Graded Benefit Plan.

| Plan | Graded Benefit |

|---|---|

| Issue Ages | 50-85 years old |

| Face Amounts | Min:$2,500 Max:$40,000(Ages 50-80) Max $25,000(Ages 81-85) |

| Benefits | Graded Death Benefit: Year 1: 30% of face amount payable Year 2: 70% of face amount payable Year 3 and above (non-accidental death): 100% payable Accidental death: Pays full face amount |

| Simplified Application | Answer simple health questions and no medical exam |

| Grace Period | 31 days for all states |

Guaranteed Assurance

This is their guaranteed issue product which means acceptance is guaranteed and there are no health questions. This is one of the best life plans for consumers with moderate health conditions that cannot qualify for day one coverage.

This plan has a 2-year waiting period for benefits to be paid to your beneficiary. If you die within those first 2 years the plan will pay your family 110% of the premiums paid. This is really a great benefit you cant get a 10% return anywhere else.

If death occurs due to an accident the full benefit is paid regardless of the waiting period.

Below is a table outlining the benefits and features of Great Westerns Guaranteed Assurance Plan.

| Plan | Guaranteed Assurance(Guaranteed Issue) |

|---|---|

| Issue Ages | 40-80 years old |

| Face Amounts | Min: $1,000 Max: $25,000 |

| Benefits | Child/Grandchild protection rider (optional): Pays $2,500 on death of dependent child or grandchild |

| Simplified Application | No health questions and no medical exam |

| Grace Period | 31 days for all states except, FL, ND, and SD 60 days in FL,ND,SD |

| Waiting Period | Limited Death Benefit: Years 1 and 2.5: 110% of premiums paid minus any loan After 2 years , full death benefit paid |

Policy Riders

Great Western Life Insurance has 4 riders for their assurance plus plan.

- Terminal Illness Rider

- Chronic Illness Rider

- Child Rider

- Grandchild Rider

The Terminal Illness and Chronic Illness riders function similarly terminal illnesses allow the insured to withdraw money from the face amount if death is expected within 12 months.

The Chronic Illness Rider allows an impaired person to withdraw a portion of the face amount if they cannot perform activities of daily living such as bathing, eating, dressing toileting, or transferring from a bed.

Child Rider/Grandchild Rider

This allows the insured to add on a child or Grandchild to their policy for additional coverage of up to $2,500.

It is important to note that the child or grandchild must be legally adopted or related to the proposed insured.

Great Western Burial Insurance

Now Great Western has one of the best guaranteed issue burial insurance products.

This is their Guaranteed Assurance Plan. This insurance plan is perfect for seniors with severe health conditions like Dementia, Alzheimers, HIV, or Cancer. Any senior with severe health issues can buy this coverage in just a few minutes.

Great Western is able to offer such great coverage because they are backed by American Enterprise Group. Their financial rating and customer service is 2nd to none. If you have severe health issues this is the best burial insurance for you.

Great Western Insurance Underwriting

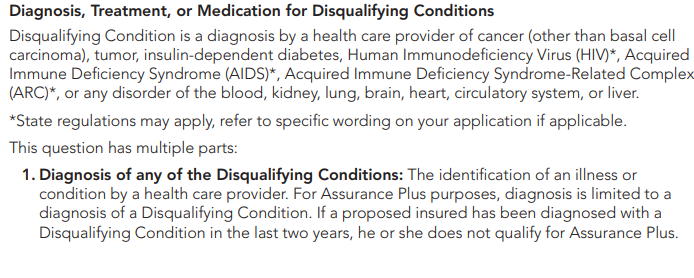

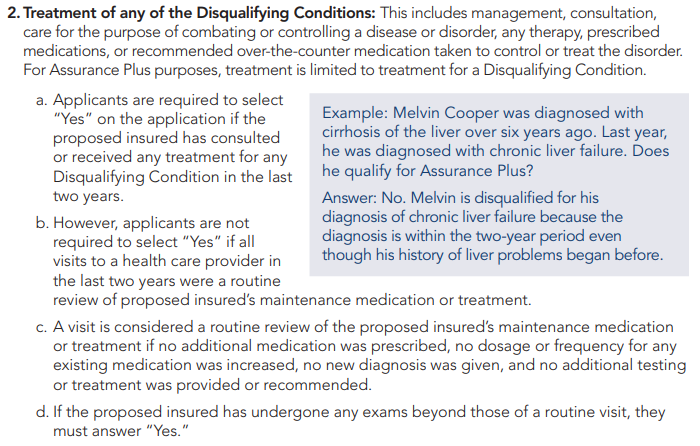

The only product that requires underwriting and answering health questions is the Great Western Life Insurance Assurance Plus product.

Below you will find their health question guidelines and based on your answers & the MIB and prescription checks this will determine your eligibility.

Great Western life Insurance Quote

To see quotes for Great Western Insurance fill out the form to your right and you will be connected with one of our agents.

Frequently Asked Questions

“How do I pay for it?”

We always recommend doing a direct draft from your bank so the policy never lapses instead of a credit card.

“What about preneed funeral insurance?”

It is a terrible option compared to these types of life insurance. The preneed stays with one funeral home and will not travel with you if you die outside of your state so for example texas residents die in Georgia their preneed wont be able to take care of them properly.

It’s simply a bad idea.