2024 Ladder Life Insurance Review Legit?

This is going to be our Ladder Life Insurance Review. We are going to cover all of the ins and outs concerning this agency because they are definitely not a life insurance company.

We did the digging so you do not have to. When it comes to any life insurance product it is important to do your due diligence and really find out if the life insurance coverage is the best thing for you.

Now our agency specializes in burial insurance for seniors which is final expense life insurance. That being said we are also highly trained in other life insurance products such as Term Life Insurance also.

The Ladder Life Insurance commercial is probably where you first heard of the company to begin with. This commercial may be funny but it does not give any information on the type of life insurance being promoted.

It also does not indicate if medical exams are required or how much money a policyholder can receive compensation.

If you do not know how much of an amount of coverage you can receive for the death benefit how can you possibly make an informed decision to purchase the right coverage for yourself?

The lack of transparency among these agencies is a huge problem. A “one size fit’s all” approach is not the way to do business.

You as the client should always come first whether it is for burial expenses or replacement of income, mortgage protection, or all the above.

Making sure your loved ones are protected when you die is our goal here at ParamountQuote and we would hope Ladder Life Insurance feels the same.

That being said let’s jump into it in this Ladder Life Insurance Review.

Table of contents

Is Ladder Life Insurance Whole or Term?

Ladder offers Term Life Insurance. This is a product that covers an individual for a limited period of time. In most cases, applicants can apply for a term length of 10, 20, and 30-year term life insurance.

This type of life insurance is used as mortgage protection and loss of income due to a loved one passing away.

This affects a family’s personal finance and without any kind of life insurance in place, this can hurt them financially in more ways than one. This type of coverage is aimed at young adults in the ages of 20.

Does Ladder Offer Whole Life Insurance?

No ladder life insurance does not offer whole life insurance policies to consumers. You cannot get a permanent life insurance plan with ladder life insurance. They only sell term life insurance products which is temporary insurance.

Ladder Life Insurance Carriers

According to their website in the “About” section, They have 2 carriers displayed.

- Fidelity Security Life Insurance Company

- Allianz Life Insurance Company of North America

- Allianz Life Insurance Company of New York

If this is the only life insurance company they represent then this is a huge red flag.

This means they are limited on the options they can offer you. You should never under any circumstances work with an agency that has only 2 companies to offer you coverage.

We represent over 15 top-rated life insurance companies in the USA. This guarantees that our agents will find you the best coverage and rate period.

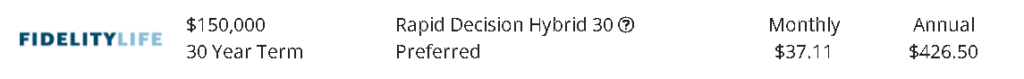

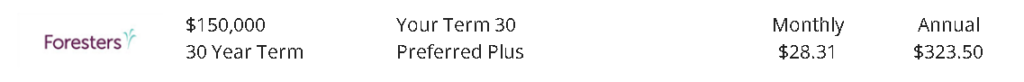

Fidelity is also more expensive than other term carriers. Here are their prices compare to Foresters.

This is based on a male born 1/18/1980 Non Tobacco.

The Gimmicks

Now one of the highlights of Ladder Life Insurance Review is the fact that they offer what they describe as “laddering” your life insurance coverage. Basically, they claim that as the years go on and you get older and pay off more of your mortgage you can lower your term coverage to make it less expensive.

This makes perfect sense, the more you pay into your mortgage the less coverage you are going to need and you should not have to pay more for coverage that is not needed. Here at ParamountQuote, we are all in for that kind of approach however there is nothing unique about “laddering”.

An editorial team on their website may make “laddering” sound great and unique but all it really is amending your policy. You could do this yourself by calling your life insurance carrier customer service number and asking for it.

Talk about slick right?

Another gimmick in this Ladder Life Insurance Review is the fact that they advertise their policies as “Starting at $5 a month”. This sounds extremely similar to the Colonial Penn $9.95 Plan.

“Life insurance rates are always based on your age, health, and gender. There is no such thing as a starting price.”

These gimmicks and lack of transparency should be enough to make any consumer say “no thank you.” but unfortunately that is the power of advertising.

Is Ladder Life Insurance Good for Seniors?

We do not recommend Ladder for seniors over 60, 70 or 80 because the age limit to apply for ladder life insurance is 60 years old. This means if you are a senior above the age of 60 you cannot apply for term life insurance through ladder life insurance.

Ladder Life Insurance Pricing

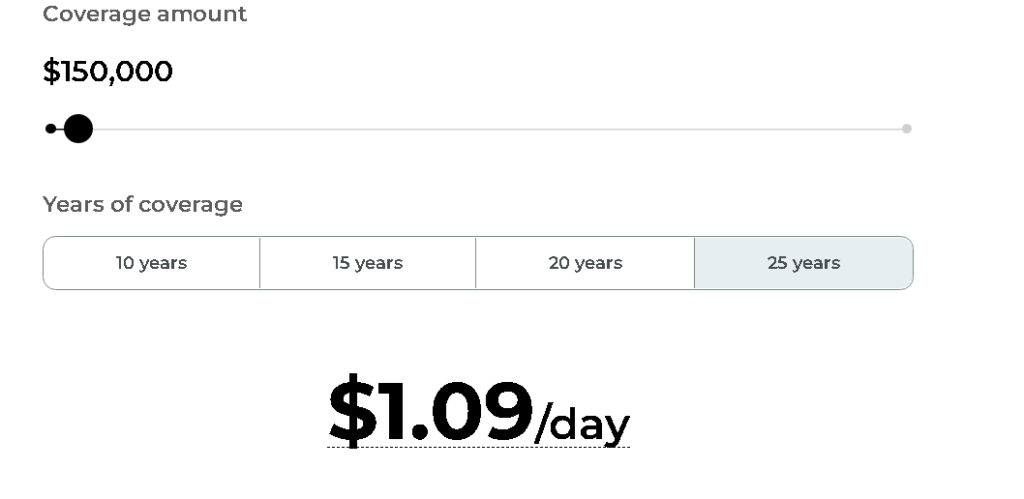

Due to the lack of transparency on their site, we could not successfully get an accurate price quote for their plans. Instead, when attempting to generate quotes from their site we were met with this daily figure instead.

Now based on the information we did collect it looks like $1.09 a day calculates to $32.70 monthly for what looks like a 25-year term policy.

Foresters which is one of our top term carriers offer a 30-year term for $28.31 monthly. This is all based on a male non-smoker with a birthdate of 1/18/1980.

Based on the information we have gathered for this Ladder Life Insurance Review you will be overpaying for your term life insurance with them. They do not have a quoter on their website like ours.

This is why we believe so strongly in transparency. You should be able to visit a site and view quotes on the page to properly conduct your research for a properly informed decision to protect your loved ones from any financial burden that will happen as a result of your death.

Their website does not even have a location listed of where this agency is based. The secrecy and lack of transparency seem a bit over the top.

Ladder Life Insurance Reviews, Ratings & Complaints

There are several positive Ladder Life insurance reviews on Trustpilot from customers. The most recent one as of May 18, 2023 expressed that the application process was “super easy”.

Ladder Life Insurance Company(Affiliate to Ladder Life Insurance) holds an A (Exceptional) Financial Stability Rating from Demotech.

Ladder Life Carrier Ratings

The two life insurance companies offered by ladder life have very good ratings.

- Fidelity Security Life Insurance Company – BBB rating A+

- Allianz Life Insurance Company of New York – Moody’s Rating is A1, Standard & Poor’s Rating is AA

Is Ladder Life Insurance Good?

From everything, we have covered in this Ladder Life Insurance Review no we cannot recommend them.

Considering that they only have a couple of companies to choose from that does not guarantee you the best rate and you will overpay with a carrier like Fidelity Life. You cannot view accurate pricing so you know exactly how much it will cost.

They use misleading gimmicks like “starting at $5 a day” when this is not true at all. The only real pros we see is the fact that they are a legitimate agency and if you contact them they will be able to get you to term life insurance however it will not be the best plan and rate for you.

Frequently Asked Questions

Is Ladder Insurance Legit?

Yes, Ladder life insurance is a legitimate agency offering legitimate term life insurance. However you can find lower priced term life insurance with other insurance agencies.

Work With ParamountQuote

We are a national independent life insurance broker.

With over 20 life insurance carriers in our portfolio, we guarantee our clients the best coverage at the best rates nationwide. We specialize in all types of life insurance primarily burial insurance but also term life insurance.

We pride ourselves on holding our client’s hands every step of the way and helping you make an informed decision to protect your family from loss of income and final expenses when you die.