Life Insurance Savings Group Review in 2024 Legit?

So you either saw a TV commercial or read somewhere about life insurance savings group and are wondering who are they? What are they? Are they any good? In this review, we are going to find out.

It is always important to do your due diligence when looking into permanent life insurance for your final expenses so your loved ones are not left with a huge funeral bill when you die. This is why having the best insurance company and best deal is so crucial to protect your family.

That being said in this Life Insurance Savings Group Reviews we can tell you bluntly they are not the best deal. Let’s go over all the ins and outs about this company and its gimmicks.

Table of contents

- What is the Life Insurance Savings Group?

- Their Products

- Does lifeinsurancesavings.com Provide Actual Pricing?

- Cost of Life Insurance Savings Group Guaranteed Issue Policy

- Life Insurance Savings Group Commercial Gimmicks & Red Flags

- Life Insurance Savings Group Prices

- Life Insurance Savings Group Mike Ditka

- Life Insurance Savings Group Not Accredited with BBB

- Work with ParamountQuote

- Q/A

What is the Life Insurance Savings Group?

They are actually an insurance agency NOT an insurance company that is a big difference. They are a marketing brand of the insurance agency SelectQuote. An insurance company is an actual insurance carrier, for example:

Mutual of Omaha is an insurance company where the only plan they have is Mutual of Omaha products.

An agency is a company in which an insurance agent or agents represent multiple carriers to offer a lot of different options that best suit each individual client’s needs.

That is exactly how we operate here at ParamountQuote.

It is a good thing for Life Insurance Savings Group to be an agency, however, there are major red flags revolving around their level of transparency.

You will not find any information on their website going over the fine print of their policies in detail which is not good. The fine print can distinguish a universal life policy from a final expense policy.

Without transparency that is what makes life insurance savings group reviews lackluster.

Their Products

What we do know despite the lack of information from their website lifeinsurancesavings com is that they deal primarily in Term life insurance and final expense life insurance.

Their burial insurance also known as whole life insurance does not require medical exams which considering that most burial insurance companies do not require exams is nothing special.

Companies they Represent

Due to the lack of information from their site we do not know exactly what insurance companies they represent but they have the logo’s of a few companies:

Their benefits for Whole Life are straightforward:

- Fixed Monthly Premiums

- Coverage Never Decreases

- Build Cash Value

- Coverage Amounts $2000 – $40000

- Applicant Age Range 45 – 85 for Level Benefits

- Applicant Age Range 45 – 80 for Graded Benefits (2 year Waiting Period)

They apparently sell United of Omaha according to their commercials because the commercial says their policy is underwritten by them. Now this particular product for Mutual of Omaha final expense insurance is called Living Promise Whole Life.

Coverage amounts for this plan are between $2,000 – $50,000, ages to apply are 45 – 85, and no waiting period. Qualification for coverage is done through answering health questions on their life insurance application.

Term Life

Due to the lack of transparency from their website we could not find out any specific information on their term coverage or carriers. We could not even find information on if the term premiums would increase or not.

You should NEVER for any reason purchase term insurance for your final expenses because the term terminates. Term is temporary coverage for the term length you are given.

Without any information on their term products for life insurance savings group how are you supposed to know if the term insurance costs go up every 5 years like Globe Life. This is cause for concern if these simple questions are not answered.

Does lifeinsurancesavings.com Provide Actual Pricing?

They have a spot on their website lifeinsurancesavings.com for you to click thinking you will get a quote. If you put in all your personal information all that will happen is you will receive a message saying a life insurance agent will reach out.

It will not show you any kind of pricing which is a common practice among these types of companies. The tactic allows them to call you and pitch you a product plain and simple. Our quoting tool compared to lifeinsurancesavings.com provides you with actual pricing on final expense life insurance before you ever speak to one of our agents.

We are dedicated to transparency here at this agency and would prefer you to know the costs upfront for burial insurance.

Cost of Life Insurance Savings Group Guaranteed Issue Policy

The table below will list the cost of Life Insurance Savings Group’s guaranteed issue life insurance policy. This policy comes with an automatic 2 year waiting period before death benefits will be paid.

| Age | $10,000 Guaranteed Issue Life Insurance |

|---|---|

| 50 | $55 |

| 60 | $68 |

| 70 | $106 |

| 80 | $206 |

Life Insurance Savings Group Commercial Gimmicks & Red Flags

Mike Ditka is their paid spokesman and endorser. The former football coach of the Chicago Bears appears on their commercials 2022 ispot.tv unless your computer has it blocked by ad blockers.

Their commercial emphasizes the fact that acceptance is guaranteed regardless of health issues. Now, this may sound great at first but the reality is that any policy that advertisers guaranteed acceptance will have a 2-year waiting period.

We warn about these gimmicky commercials all the time to our clients and their false advertising. This is what we would call a bait and switch tactic.

There is nothing about this that serves you and your unique needs which is what every insurance agency should strive to be. Taking a “one size fits all” approach to protecting your loved ones from the burden of your burial expenses is not right.

The only benefit you get from a 2-year waiting period policy is a Return of Premium plus 10%. This means if you die within the first 2 years your family will only get the premiums you paid in plus 10%.

If you cannot qualify for day one coverage our agents will tell you and still assist you with getting a superior guaranteed acceptance plan like Great Western.

Furthermore, their commercials sound very similar to the gimmick commercials of Colonial Penn.

Much like the Colonial Penn $9.95 plan a month. Life Insurance Savings Group advertises $5 a week. That is how they use misleading advertising to have consumers contact them.

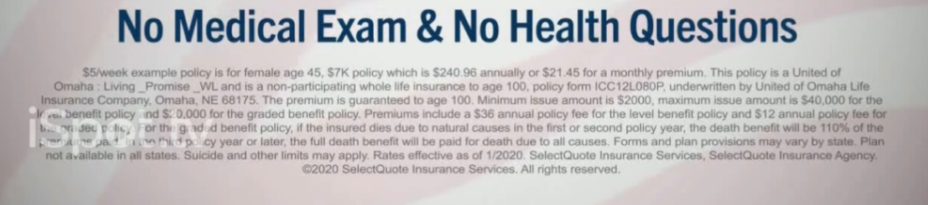

If you look at the screenshot below we show the fine print where it says specifically that the $5 per week is based on a 45-year-old female for 7,000 in coverage.

Talk about sleight of hand right?

Life Insurance Savings Group Prices

Another reason why they score so low for the Life Insurance Savings Group Reviews is the fact that there is no actual way to see quotes on their website.

They have a quoting tool on their site that will not actually show you quotes like ours will to the right of this page. When you put your information into their quoting tool you will receive a message saying one of their agents will be contacting you.

So in order to actually get quotes you have to speak with one of their agents. That is as misleading as it gets, since the tool is built to make you think you can see quotes right on their site.

Life Insurance Savings Group Mike Ditka

Mike Ditka former coach of the Chicago Bears is their paid spokesman for their final expense life insurance plan. He helps promote their burial insurance on their commercial featuring Mike Ditka.

As we mentioned they claim to represent United of Omaha but as far as getting a monthly premium price theres no way of telling through their site what product through MOO they represent.

There are no rate’s shown and no way to run a quote without speaking to them directly.

You should always read the commercial’s fine print. This goes for any commercial promoting life insurance and guaranteed acceptance. If you get a company saying you are approved no matter what with no health questions, this is always a 2 year waiting period for death benefit’s.

This is universal for any life insurance company that offers guaranteed issue life insurance.

Life Insurance Savings Group Not Accredited with BBB

Now Life Insurance Savings Group is a legitimate life insurance agency but they are not Better Business Bureau accredited. This means finding customer feedback is going to be extremely difficult in order to make an informed decision.

Without somewhere reputable to look at reviews you cant make an informed decision on if they are right for you. Being able to review any kind of customer complaints based on possible non disclosed policy features is crucial in buying life insurance.

Work with ParamountQuote

We are a national independant agency that works with all the top major burial insurance carriers nationwide.

- There is 100% transparency. You can look at all our companies and pricing by simply filling out the form to your right.

- We help 90% of our clients get day one coverage.

- The agent you work with becomes your personal service agent for life.

Q/A

“is life insurance savings group legitimate?”

Yes, they are a legitimate agency however due to their misleading advertising and lack of transparency we do not recommend them.