Understanding $25000 Whole Life Insurance Policies & Costs

If you are looking to buy & a better understanding of a $25000 whole life insurance policy you are in the right place.

Now the only type of whole life insurance that will provide this lower amount of coverage is final expense life insurance.

Universal life does not offer $25000 in whole life coverage you will never get a $25000 universal whole life policy.

Now with a $25000 final expense whole life policy the coverage is permanent meaning it never expires with level premiums(premiums never increase) and level death benefits(death benefit never decreases).

No medical exams are required just health questions on a life insurance application with health & prescription history checks.

If applying for a $25000 guaranteed issue whole life plan there are no health questions or underwriting but there is a 2 year waiting period.

In order to buy a $25000 whole life policy you must work with a licensed life insurance agent/broker to apply as most life insurance companies do not sell direct to consumers.

In this article we will cover benefits, costs, application process, list best companies & features.

Table of contents

- Understanding $25000 Whole Life Policy Options, Benefits & Features

- Term Life Insurance or Whole Life Insurance?

- How Much is a $25000 Life Insurance Policy Cost?

- Eligibility & Application Process for 25,000 Whole Life Policy

- Is there a Medical Exam?

- Underwriting & Guaranteed Issue Coverage

- Finding The Best Types of Life Insurance for a $25000 Whole Life Insurance Policy.

Understanding $25000 Whole Life Policy Options, Benefits & Features

Whole life insurance is permanent coverage that never expires as long as premiums are paid. It builds cash value that you can borrow against in addition to the policy death benefit.

A $25000 whole life insurance policy for final expenses is simplified issue whole life insurance & guaranteed issue whole life insurance plans.

These plans are the only options available with this low of a coverage amount. Universal and traditional whole life will not go this low in offering coverage.

They want to insure big ticket cases so smaller policies like $25000 are left to final expense.

There are no medical exams required for these types of policies due to the fact of lower coverage amounts means less risk to life insurance companies.

Insuring someone for $25000 compared to insuring someone for $100,000 is a big difference because the life insurance company does not lose as much when paying a claim for $25000 compared to $100,000.

All you have to do to qualify for a $25000 whole life policy is answer health questions on the life insurance company’s application and consent to medical & prescription history checks.

If everything checks out you are approved quickly within minutes or days of submitting your application.

Guaranteed Issue Approved Instantly

Guaranteed issue life insurance has no health questions or medical & prescription history checks. You are approved as soon as you apply with an automatic 2 year waiting period.

The waiting period means if you die within 2 years of having this type of policy your beneficiary will not receive the full death benefit.

It will refund the premiums paid in to the policy plus interest(usually 10%). This type of policy should be a last resort if you have extreme health conditions that do not qualify for simplified issue plans.

Term Life Insurance or Whole Life Insurance?

First and foremost, if you are asking yourself which is a better term or whole life, the truth is they are both good for different purposes with pros and cons.

We do not recommend term life when you are looking for a small $25,000 life insurance policy because term typically will not offer policies that low term life coverage amounts usually range between $50,000 – $100,000.

This is why Whole Life Insurance is the best option.

They are offer level premiums that will never go up as you get older and provide a tax-free death benefit to your beneficiary when you die so they can pay any funeral expenses, cremation expenses, or burial expenses.

Furthermore, they use easy underwriting to qualify you but more on that later.

With that being said Whole Life Insurance is hands down the best type of life insurance for coverage amounts such as $25,000 to make sure your final expenses are taken care of.

25000 Term Life Insurance Policy

If you are wondering which companies offer the best 25000 term life insurance policy we will list them below.

10 Year Term Best Companies

- Assurity

- Transamerica

- Fidelity

- Mutual of Omaha

15 Year Term Best Companies

- Assurity

- Transamerica

- Americo

- Mutual of Omaha

- Fidelity

20 Year Term Best Companies

- Assurity

- Transamerica

- Americo

- Fidelity

- Prosperity

25 Year Term Best Companies

- Transamerica

- Americo

30 Year Term Best Companies

- Assurity

- Americo

- United Home Life

As you can see the higher we go in term lengths the less companies there are offering a 25000 term life insurance policy.

How Much is a $25000 Life Insurance Policy Cost?

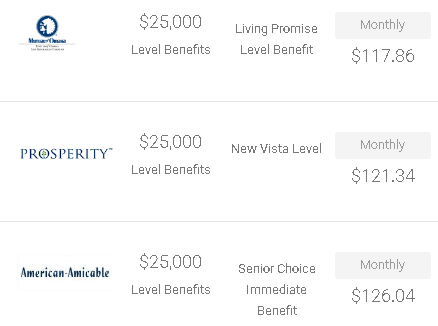

Rates for a $25000 life insurance policy are based on an individual’s age and health for a 63-year-old male non-smoker a $25000 life insurance with Mutual of Omaha Living Promise is $117.86 monthly.

So when it comes to a $25,000 whole life insurance policy the rates can range for individuals between $50 – $100 on average depending on your age, health, and gender.

| Age | $25,000 Whole Life Male Non Smoker | $25,000 Whole Life Male Smoker | $25,000 Whole Life Female Non Smoker | $25,000 Whole Life Female Smoker |

|---|---|---|---|---|

| 49 | $53.90 | $75.41 | $43.20 | $53.51 |

| 50 | $55.41 | $77.15 | $44.82 | $55.52 |

| 51 | $56.91 | $78.90 | $46.41 | $57.56 |

| 52 | $58.41 | $80.66 | $47.96 | $59.48 |

| 53 | $58.41 | $82.39 | $49.42 | $61.30 |

| 54 | $61.65 | $84.41 | $50.88 | $63.13 |

| 55 | $63.15 | $85.66 | $52.15 | $65.05 |

| 56 | $64.66 | $87.16 | $53.44 | $66.95 |

| 57 | $66.65 | $88.66 | $54.67 | $68.77 |

| 58 | $68.66 | $90.65 | $55.82 | $70.51 |

| 59 | $69.33 | $93.68 | $56.98 | $72.24 |

| 60 | $72.64 | $93.87 | $59.52 | $76.08 |

| 61 | $90.25 | $98.31 | $78.75 | $113.90 |

| 62 | $94.84 | $148.91 | $83.00 | $119.64 |

| 63 | $114.73 | $156.94 | $87.55 | $125.36 |

| 64 | $120.53 | $165.44 | $92.43 | $131.10 |

| 65 | $126.77 | $174.42 | $97.70 | $136.84 |

| 66 | $134.37 | $185.31 | $106.38 | $145.74 |

| 67 | $142.61 | $196.97 | $110.66 | $154.19 |

| 68 | $151.54 | $209.45 | $118.65 | $168.07 |

| 69 | $161.26 | $222.84 | $124.34 | $175.38 |

| 70 | $176.33 | $237.15 | $130.03 | $182.71 |

| 71 | $183.40 | $252.97 | $135.70 | $185.68 |

| 72 | $183.40 | $269.80 | $141.33 | $195.38 |

| 73 | $209.70 | $287.69 | $154.06 | $206.38 |

| 74 | $209.70 | $306.74 | $164.65 | $217.69 |

| 75 | $240.84 | $327.15 | $176.22 | $232.08 |

| 76 | $256.84 | $347.18 | $190.82 | $250.12 |

| 77 | $274.30 | $368.91 | $203.97 | $266.64 |

| 78 | $293.45 | $392.65 | $216.29 | $283.91 |

| 79 | $314.42 | $418.79 | $228.73 | $308.57 |

| 80 | $337.41 | $447.75 | $241.28 | $333.04 |

| 81 | $356.85 | $470.95 | $260.73 | $362.79 |

| 82 | $378.07 | $496.53 | $280.08 | $396.58 |

| 83 | $401.15 | $524.03 | $298.46 | $422.10 |

| 84 | $426.11 | $553.30 | $316.57 | $443.09 |

| 85 | $452.84 | $584.15 | $334.95 | $461.00 |

| 86 | $585.38 | $979.13 | $423.06 | $636.34 |

| 87 | $686.44 | $1127.88 | $509.69 | $742.22 |

| 88 | $787.50 | $1276.63 | $596.31 | $848.09 |

| 89 | $888.56 | $1425.38 | $682.94 | $953.97 |

Eligibility & Application Process for 25,000 Whole Life Policy

Below is going to be a table representing the eligibility requirements of a final expense whole life policy.

A final expense life insurance policy offers $25,000 in death benefit and is easy to qualify for which makes this the ideal product for consumers looking for a smaller amount of coverage.

The eligibility requirements are as follows:

| Eligibility Requirement | Description |

|---|---|

| Age & Date of Birth | Your current age determines your eligibility with different policies. If you are older than age 85 for example a majority of life insurance companies will not offer you burial insurance. |

| Height & Weight | You current heigh and weight affect your eligibility with some life insurance companies because high risk health conditions are directly linked to obesity. |

| Resident State | Your resident state determines which plans are available to you. Some life insurance companies may not have their policies available in your state. |

| Current & Past Health History | Your health determines your eligibility for burial insurance. If you hav extreme current or a past history of health conditions such as cancer you are considered high risk and many life insurance companies may not accept you. |

| US Citizenship | You must be a US citizen or permanent resident to buy burial insurance in the United States. If you are a citizen of a different country you are not eligible. |

| Current Medications | Your current medications indicate to the life insurance company how your health is. This is how they can categorize you as a high risk applicant or not. |

| Criminal History | A criminal history indicates if you are a high risk. If you have an extensive criminal record life insurance companies will not accept you. |

Application Process How to Apply for a 25k Life Insurance Policy?

We are going to list the steps below on how to apply for a $25,000 life insurance policy. The table will outline the simple steps to applying for this coverage.

| Steps to Apply | Description |

|---|---|

| 1. Speak with a Licensed Insurance Agent or Agency | In order to buy burial insurance you must speak with a licensed life insurance agent that sells the product. You cannot apply for majority of burial insurance products on your own. |

| 2. Answer Health Questions & Provide Your Prescriptions | You must answer the health questions on the burial insurance application & provide your medications. The Life Insurance company will look at the Medical Information Bureau Health Report and run a Script Check on you using your Social Security Number provided on the application. This allows them to asses your risk and determine if they will approve you. |

| 3. Provide the Name of your Doctor | The life insurance company will want to know the name of your doctor. In most cases they will never contact your doctor however, in some rare cases they can depending on what is found in the MIB reports. |

| 4. Electronically Sign your Life Insurance Application | When applying for burial insurance online you will sign for your application using an electronic signature. Depending on the company you apply it will be a voice signature, e-mail signature or Text message signature. |

| Instant Decision of Approval or Denial | Burial insurance does not require a medical exam which means when you submit your application to the life insurance company it is the last step. Depending on which company you applied with you will receive an instant decision on your application. Some companies or situations may take a few days for a decision. |

25000 Whole Life Policy Sample Quote Rates

When it comes to getting 25,000 whole life insurance amount of coverage you are probably wondering what the average pricing for specific ages would be.

We have included several tables below to go over average pricing for a 25000 whole life insurance policy.

Keep in mind these rates are based on individuals with a good medical history that qualify for the lowest rates available which makes this coverage a great option.

To see specific quotes for yourself fill out the form to the right.

Is there a Medical Exam?

The best part about a 25000 whole life insurance policy with us is there’s no medical exam required.

Other policies such as Universal Life Insurance and Term Life Insurance will require a medical exam.

This means they will send a medical professional to your home and do a blood test and physical to make sure you qualify for coverage.

Term life is also not permanent their policies can expire after 10 years, 20 years, or even 30 years.

With Whole Life, they do have health questions but they will not require a medical exam and coverage can be purchased with an instant decision from the carrier right over the phone.

Top Life Insurance Companies for a $25000 Whole Life Insurance Policy

Our Top Carrier’s are:

These are the top carriers our agents recommend to our clients who are looking for permanent life insurance. These policies can be used as burial insurance, cremation insurance, funeral insurance, etc. In fact, these are marketing terms for whole life insurance.

It’s all about what life insurance plan best fits you and your unique needs.

Underwriting & Guaranteed Issue Coverage

The carriers our agency works with use easy underwriting. What this means is that all they do to make sure you qualify for their coverage is a Medical Information Bureau Health Report and Prescription check using your Social Security Number.

Medical Information Bureau (MIB)

This is a database where every time you have ever seen a doctor or been to a hospital or been diagnosed with some sort of condition in your life is stored.

The insurance carrier looks at this database while you are buying life insurance and determines whether you are insurable.

Furthermore, they are only looking for serious health conditions like current cancer treatment or oxygen usage with COPD.

If you have type 2 diabetes for example you still have a huge shot at being approved for level day one coverage.

In fact, we help 90% of our clients get approved for day one coverage even with moderate health conditions like COPD, CHF, Diabetes, etc.

Prescription Check

They will also look at your prescription history. Just like with the MIB report they are just looking for major red flag types of medications. These medications can include:

- Aducanumab

- Donepezil

- Rivastigmine

- Galantamine

- Memantine

- Suvorexant

- Leukeran

- Altretamine

- Bendamustine

- Busulfan

- Carboplatin

- Carmustine

- Chlorambucil

- Cisplatin

- Cyclophosphamide

- Dacarbazine

- Ifosfamide

- Lomustine

- Mechlorethamine

- Melphalan

- Oxaliplatin

- Temozolomide

- Thiotepa

- Trabectedin

- Decitabine

- Floxuridine

- Fludarabine

- Gemcitabine (Gemzar)

- Hydroxyurea

- Methotrexate

- Nelarabine

- Pemetrexed (Alimta)

- Pentostatin

- Pralatrexate

- Thioguanine

- Trifluridine/tipiracil combination

The type of coverage you can qualify for can determine the price of your premium payments and what type of death benefit you can be offered.

Guaranteed Issue Life Insurance

If you do not qualify for level day one coverage may be because you have a very serious health condition or one of the above medications you can still get a $25000 whole life insurance policy.

This would make a guaranteed issue life insurance policy your best option. they do not have any health questions and approval is guaranteed.

Furthermore, you will have a 2-year waiting period before your beneficiary will receive the benefits if you die. These policies will offer up to a maximum of $25000 for coverage so no matter what you cannot be denied.

Finding The Best Types of Life Insurance for a $25000 Whole Life Insurance Policy.

Finding the best whole life insurance policy is simple. Work with us here at ParamountQuote.

You can fill out the form to your right to see instant life insurance quotes and speak with one of our licensed agents to ask any questions you may have.

We are a national independent agency that specializes in burial insurance. You do not have to drive into town to speak with us like a local state farm office. We are national and just a phone call away.

Furthermore, our agents are trained in the underwriting niches of these life insurance companies which means that we help clients with health conditions like Congestive Heart Failure find day one level coverage. This means you will have the best policy with the lowest rate available.

Our agents also become your personal service agents for life so if your family needs help submitting a death claim in the future or needs policies on themselves our agents are on call to assist whenever your or your family needs them.

We also specialize in burial insurance so this means we know all of the ins and outs of these companies and their policies.

Talk to The Experts

This is why deferring to us as the experts are your best solution to understanding how to get the best deal available for you.

We pride ourselves on holding our clients hands every step of the way and making sure you have the very best coverage available to you in the state you reside in.

We have represented all of the top major carriers nationwide and do business in all 50 states.

If you decide not to work with us make sure that whatever agency you work with is a national independent agency of brokers with the right training.

This will make sure that you find the best type of life insurance available.