Philadelphia American Life Insurance Review Not Good

Based on our Philadelphia American Life Insurance review we are going to conclude that it is not good for seniors. This is because it offers a low coverage amount ($25,000 maximum) and there is only one product to qualify for which is a final expense policy. There are no guaranteed issue options available if a senior fails the underwriting for Philadelphia Americans final expense life insurance policy they will have to look at a different company to qualify period.

In this article we will provide an overview of their product, customer ratings & reviews, who they are and their background with contact information.

Table of contents

- Philadelphia American Life Insurance Product Overview

- Philadelphia American is Under New Era Life Insurance Company

- New Era Life Insurance Company Products

- Philadelphia American Life Insurance Ratings & Reviews

- Philadelphia American Background & Contact Information

- Philadelphia American Life Insurance Review Conclusion

Philadelphia American Life Insurance Product Overview

The only life insurance policy available with Philadelphia American is a final expense whole life insurance policy. These types of policies are deigned for end of life expenses(burial, funeral, cremation etc.) because they never expire, have premiums that never increase and death benefits that never decrease.

Coverage stays in force as long as premiums are paid in addition cash value builds in the policy that can be used for any purpose the insured desires. The policy pays out in a lump sum tax free benefit amount to the named beneficiary on the policy which they then use to pay the end of life expenses of the insured.

Any money left over after expenses are paid is for the beneficiary to keep for any purpose they want to use it for. These types of policies are the perfect burial insurance option for seniors because they have simplified underwriting with no medical exams, fast approval process and can accept most moderate health conditions seniors will typically have in their older age brackets.

In addition to this there is also guaranteed issue life insurance which has no medical exams or health questions. These policies are designed to be guaranteed acceptance to seniors with serious health conditions like Dementia or Cancer.

Policies like this always have a 2 year automatic waiting period before the policy will payout with a return of premium feature(ROP) of usually 10% interest on top of premium returned to the beneficiary if death occurs during the waiting period.

Philadelphia American Only Offers Simplified Issue Plan Big Problem

Now the only option available to you for final expense insurance from Philadelphia American is going to be their simplified issue policy. If you have severe health issues like Dementia you will not be able to get any type of Philadelphia American life insurance policy. You will have to look else where which is a major hassle.

Policy Details

- Coverage Amounts – $2,000 – $25,000

- Applicant Age Range: N/A

- Premiums Never Increase

- Death Benefit Never Decreases

- No Waiting Period

- Plan Levels: Level Plan & Modified Plan

They do not give a lot of information regarding their final expense plan on their website aside from what we managed to list here. With that being considered how are you supposed to know if their coverage is best for you? What if you need more coverage than just $25,000?

Its clear that Philadelphia Life Insurance is not good for everyone considering Mutual of Omaha’s final expense plan offers a maximum of $50,000 in coverage. There are several highly rated life insurance companies offering much more coverage than $25,000 like American Amicable, Aetna, Transamerica and Prosperity Life.

Also how do you know if you will pass their underwriting? They do not have any of the health questions to qualify for their product listed on their website. This means you are flying blind if you call them and attempt to apply for this plan.

If you get denied you will be stuck having to shop somewhere else for a policy that will accept you depending on your health issues.

Philadelphia American Life Insurance Health Questions

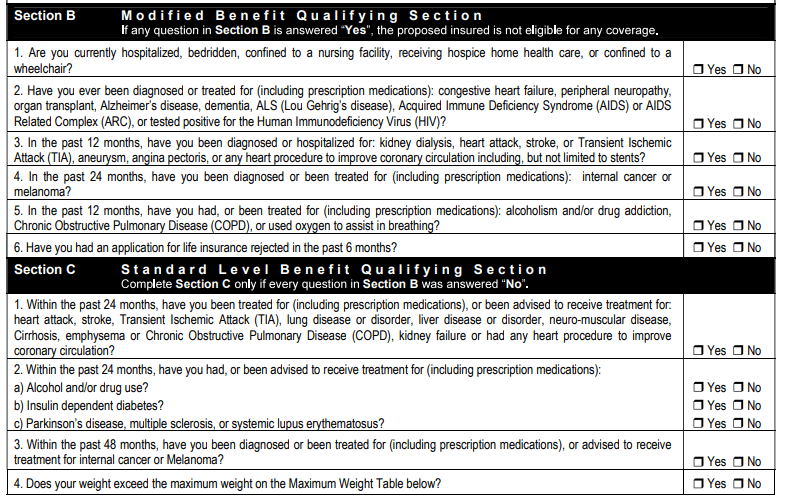

In section B of the health questions the second questions asks if an applicant has “ever” been diagnosed with Congestive Heart Failure. The application makes it clear that if you have ever been diagnosed with that condition you will not get coverage.

This is a perfect example of how not every life insurance company is good for specific individuals. Prosperity life will offer immediate coverage to you if you have Congestive Heart Failure diagnosed over 2 years ago with no complications.

According to the Philadelphia life insurance application there are 2 different plan levels which are the level & modified plans. Level benefits would be no waiting periods and Modified benefits would be a waiting period.

The application we found does not indicate how long the modified benefit waiting period is. That being said you should not settle for a policy like this when it puts you in unnecessary waiting periods. Work with a broker to find the best plans period.

Don’t Work Directly With Life Insurance Companies

Do not work directly with a life insurance company to obtain burial insurance because that is what usually happens. You will be offered only one option and most of the time it will be a guaranteed issue policy with a 2 year waiting period.

In this scenario with Philadelphia life insurance it will be a simplified issue policy with health questions and no waiting period but it only offers a dismal amount of $25,000 in coverage. With better options out there for you that have upwards of $50,000 in coverage. Why settle for a policy like this?

Working with a life insurance broker is how you will actually find the best burial insurance for your needs. There is no extra charge for using life insurance brokers because they are paid directly by the life insurance companies.

Life insurance brokers like us have the ability to shop all the best life insurance companies for you. A broker like us will match you with a company that accepts your specific health conditions, provides the right coverage amounts up to $50,000, fits your budget and has a solid reputation.

Philadelphia American is Under New Era Life Insurance Company

Now Philadelphia American is actually under the umbrella of New Era Life Insurance company making them the same. New Era Life Insurance company is the underwriter of Philadelphia American’s life insurance product for final expenses.

New Era Life Insurance Company Products

This company who is the actual owner of Philadelphia Life Insurance Company offers several insurance products.

New Era Life Products

- Accident Insurance

- Annuities

- Critical Illness Insurance

- Dental Insurance

- Final Expense Insurance

- GAP Insurance

- Medicare Supplements

- Health Indemnity Plans

Philadelphia American Life Insurance Ratings & Reviews

Both Philadelphia American & New Era Life have several negative reviews from upset customers revolving mainly around the health products. Keep in mind that Philadelphia American is not BBB accredited nor is New Era Life Insurance Company.

Their scores are below as you will see they are poorly rated on several sites:

Philadelphia American Life Insurance Reviews

- Better Business Bureau Rating – 2.55 stars out of 5 as of 12/17/2023

- Yelp Rating – 1.0 out of 5 as of 12/17/2023

New Era Life Reviews

Better Business Bureau Rating – 3 out of 5 stars as of 12/17/2023

Financial Ratings

Now they do have strong financial ratings which means they have the ability to pay their claims. Their financial strength ratings are as follows:

A. M. Best Rating – A-(Excellent)

Philadelphia American Background & Contact Information

They were founded in 1924 and had a management change in 1989 with their core values being loyalty, consumer oriented, reliable, flexible, innovative and visionary.

Contact Information:

- Corporate Address 11720 Katy Freeway, Suite 1700, Houston, TX 77079

- Mailing Address P.O. Box 4884, Houston, TX 77210-4884

- Medicare Policyholder Phone – 1-877-417-7555

- Annuity Inquiry Phone – 1-800-860-7157

- Website: https://apps.neweralife.com/site/

Philadelphia American Life Insurance Review Conclusion

Philadelphia American Life Insurance is not a good product for everyone because it only offers a maximum of $25,000 in coverage, can be hard to qualify for and if you get rejected you are left in the cold to look somewhere else.

Consider working with an actual life insurance broker like us that can shop the market of all the best life insurance companies available. Our agents know exactly which companies are accepting of your health conditions. In addition to this there will be no unnecessary waiting periods or time wasted getting declined.