Life & Burial Insurance for Seniors Over 70 Cheap & Best

Are you wondering what your options are for burial insurance for seniors over 70? The best final expense insurance for seniors over 70 is with Mutual of Omaha, Prosperity Life, Aetna and American Amicable.

Those companies offer the cheapest burial life insurance for seniors over 70.

Now in order to get one a policy with those companies you must work with a licensed life insurance agent like us in your state. Over 70s life insurance does not have to be complicated it can be very simple.

Average costs for final expense insurance for seniors over 70 is going to be between $50-$100 monthly on average.

Plans are permanent(whole life policies) with premiums that never increase and coverage that never decreases.

You are going to have to answer health questions on an application to be eligible but there are no medical exams.

If you are in extremely poor health you should get burial life insurance for seniors over 70 that does not have health questions(guaranteed issue life) it does have a 2 year waiting period.

This article will cover what these plans are, costs, best companies & how to apply.

Table of contents

- What is the Best Life Insurance for Seniors over 70?

- Burial Life Insurance Policy Cost for Seniors Age 70 – 79

- Best Final Expense Insurance Companies for Seniors over 70

- Benefits of Burial Insurance for Seniors over 70

- Burial Insurance over 70 Eligibility Requirements

- How to Apply for Burial Insurance

- Our other Articles on Burial Insurance for Seniors Age 71 – 79

- Is this Insurance the Best option for Seniors?

- Does this insurance have a waiting period?

- Does this insurance require a medical exam?

- Can an agency help me with purchasing life insurance for myself or a family member?

- FAQ

- Final Expense Insurance for Seniors over 70 Coverage Amounts & Additional Benefits

- Life Insurance for Parents Over 70 Pricing

How to Find the Best Burial Insurance for Seniors over 70

Burial insurance for seniors over 70 is simple it does not have to be complicated when it comes to permanent life insurance.

As with any product or service to find the very best you need to work with the experts like our insurance agents.

Final expense insurance for seniors over 70 is lifelong coverage that will protect your family.

Over 70s life insurance is what the term burial insurance for seniors over 70 actually means.

That is the bottom line to finding the best life insurance coverage.

Now the reason for this is the fact that our expert-level training enables us to find you day-one coverage depending on your health conditions.

The best burial life insurance for seniors over 70 comes down to a few specific things.

- Is there a waiting period?

- Is the premium the lowest monthly rate possible?

- Is the company A-rated and been in business for a long time?

- Do the premiums ever Increase?

- Does the coverage ever decrease?

Those are the key questions to ask about this specific product.

Again since this insurance is a type of permanent coverage all of the above should be answered with a “no” except for the waiting period because if your health conditions are too severe a waiting period may be your only option in some cases.

This type of coverage is guaranteed issue whole life insurance. Now when it comes to burial insurance for seniors over 70 you are either going to qualify for a waiting period or non waiting period.

It depends on the life insurance offerings from the carrier.

That being said the terms and conditions of the policy contract should reflect the questions above. The policy would also state if the death benefit is tax free and if there is any additional accidental death coverage.

Keep in mind you can also get this funeral cover for parents over 70 if you have an insurable interest in them.

You can see real-time burial insurance quotes for seniors over 70 by filling out the form to your right and we will provide some in this article.

What is the Best Life Insurance for Seniors over 70?

The best burial life insurance for seniors over 70 is final expense insurance which is funeral insurance. The reason this is the best option is that once you are 70 years old or older your chances of passing a medical exam for any term life products are drastically slim.

In addition to this if you are 70 or older term companies would only offer you a 15 year term and if outlive the 15 years the rates will double if you try to renew it.

This results in your life insurance policy becoming too expensive for you to keep and you end up dropping the coverage. When that happens funeral insurance is twice as expensive because you are older in age.

That is why getting funeral insurance for seniors over 70 now with a locked-in rate is your best option to make sure your final expenses are covered.

Burial Life Insurance Policy Cost for Seniors Age 70 – 79

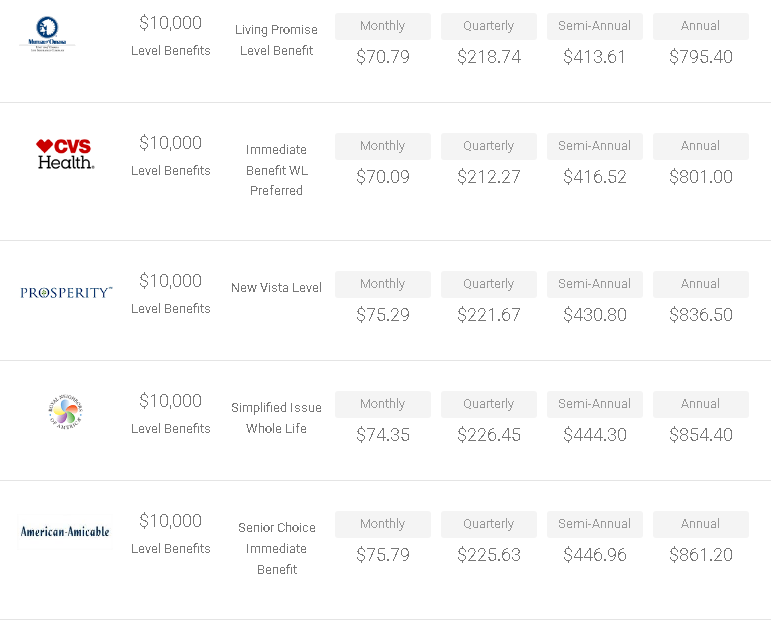

Below is an image of sample rates for burial insurance for seniors over 70.

This is a table with quotes pulled directly from our quoter to give you a comprehensive idea of how much burial insurance for seniors over 70 costs.

Funeral insurance for seniors over 70 is affordable and the healthier you are the lower your final expense life insurance rates will be.

Keep in mind when it comes to burial insurance for seniors over 70 this is whole life insurance which means once you get your policy the premium never increases.

$5,000 Burial Life Insurance Policy Cost for Seniors over 70

| Age | $5,000 Male Non Smoker | $5,000 Female Non Smoker | $5,000 Male Smoker | $5,000 Female Smoker |

|---|---|---|---|---|

| 70 | $38.97 | $29.71 | $55.28 | $40.24 |

| 71 | $41.78 | $31.95 | $59.10 | $41.11 |

| 72 | $44.60 | $34.20 | $62.31 | $45.50 |

| 73 | $47.29 | $36.34 | $66.65 | $48.00 |

| 74 | $49.03 | $38.38 | $70.03 | $50.38 |

| 75 | $51.59 | $40.41 | $74.07 | $51.58 |

| 76 | $55.12 | $43.87 | $81.62 | $56.16 |

| 77 | $58.67 | $45.52 | $88.59 | $60.37 |

| 78 | $62.67 | $45.82 | $94.63 | $64.85 |

| 79 | $66.36 | $48.31 | $99.80 | $68.70 |

$10,000 Burial Life Insurance Policy Cost for Seniors over 70

| Age | $10,000 Male Non Smoker Sample Quotes | $10,000 Male Smoker Sample Quotes | $10,000 Female Non Smoker Sample Quotes | $10,000 Female Smoker Sample Quotes |

|---|---|---|---|---|

| 70 | $70.79 | $94.64 | $50.81 | $70.45 |

| 71 | $73.15 | $98.31 | $53.24 | $72.18 |

| 72 | $78.81 | $103.97 | $56.20 | $75.86 |

| 73 | $83.99 | $109.94 | $58.46 | $79.74 |

| 74 | $89.46 | $116.69 | $63.55 | $84.14 |

| 75 | $94.87 | $123.65 | $67.78 | $88.66 |

| 76 | $99.97 | $132.48 | $72.41 | $94.42 |

| 77 | $107.04 | $141.32 | $78.25 | $101.63 |

| 78 | $114.13 | $150.57 | $83.51 | $108.24 |

| 79 | $122.13 | $161.81 | $88.44 | $115.15 |

Best Final Expense Insurance Companies for Seniors over 70

The best burial insurance companies are always going to have 2 very important factors.

- An A-Rating

- A Perfect Track Record

If a company does not have these 2 factors we highly recommend staying away from any funeral policy over 70 they offer.

The reason being is getting an A rating means the carrier is highly rated and if an insurance company cannot get an A rating they are not worth your time.

This is how you separate the fakers from the makers for burial insurance for seniors over 70. Now the cheapest burial life insurance can be found with the following companies below.

The cheapest burial life insurance for seniors over 70 would be with Mutual of Omaha.

Their rates are considerably the cheapest however underwriting can be strict depending on your health.

This is why the cheapest coverage may not always be the best. The real goal is finding a company that will insure you with no waiting periods.

If you have heart conditions the best final expense insurance for seniors over 70 is going to be with Prosperity life.

Now if you have breathing issues the best over 70s life insurance is going to be from Aetna.

The best carriers that can offer you the best funeral plan for over 70 are as follows:

- Mutual of Omaha

- American Amicable

- Greek Catholic Union

- Liberty Bankers Life

- Prosperity Life

- Transamerica

- Aetna Accendo

- Royal Neighbors of America

- AIG

- Gerber

- Great Western

We work with all of these carriers for final expense insurance for seniors over 70.

To see pricing for their policies and to speak with one of our agents fill out the form to your right.

Benefits of Burial Insurance for Seniors over 70

We have listed in our table below all of the benefits for having a burial insurance policy at age 70. These benefits will provide financial protection for your family.

| Benefit | Description |

|---|---|

| Level Premiums | Burial insurance Premiums never increase for the life of the policy |

| Level Death Benefit | Burial Insurance Death benefit never decreases for the life of the policy |

| Coverage Never Expires | Policy never expires as long as premiums are paid |

| Cash Value | Premiums paid into the policy build an additional savings to the policy’s face amount that can be borrowed against |

| Tax-Free Death Benefit | The Death Benefit to your beneficiary is 100% tax free |

| Peace of Mind | Burial, funeral and cremation expenses are all covered which gives you peace of mind |

| No Medical Exams | No medical exams required to qualify. You only answer health questions. |

| Financial Security | Burial Insurance provides the money to pay your funeral costs so your family does not have the financial burden placed on them to pay burial expenses. |

| Easy Underwriting | Burial Insurance is easy to qualify for. Even seniors with moderate health conditions can get a low premium. |

| Instant Decision | Burial Insurance uses instant decision during the application process. This means when you apply you will receive a decision of approval or denial right after the application is submitted. |

Burial Insurance over 70 Eligibility Requirements

In the table below you will find all of the requirements needed to be eligible for burial insurance.

| Eligibility Requirement | Description |

|---|---|

| Age & Date of Birth | Your current age determines your eligibility with different policies. If you are older than age 85 for example a majority of life insurance companies will not offer you burial insurance. |

| Height & Weight | You current heigh and weight affect your eligibility with some life insurance companies because high risk health conditions are directly linked to obesity. |

| Resident State | Your resident state determines which plans are available to you. Some life insurance companies may not have their policies available in your state. |

| Current & Past Health History | Your health determines your eligibility for burial insurance. If you hav extreme current or a past history of health conditions such as cancer you are considered high risk and many life insurance companies may not accept you. |

| US Citizenship | You must be a US citizen or permanent resident to buy burial insurance in the United States. If you are a citizen of a different country you are not eligible. |

| Current Medications | Your current medications indicate to the life insurance company how your health is. This is how they can categorize you as a high risk applicant or not. |

| Criminal History | A criminal history indicates if you are a high risk. If you have an extensive criminal record life insurance companies will not accept you. |

How to Apply for Burial Insurance

We have listed the steps below to apply for a burial insurance for seniors over 70. It is a very simple process.

| Steps to Apply | Description |

|---|---|

| 1. Speak with a Licensed Insurance Agent or Agency | In order to buy burial insurance you must speak with a licensed life insurance agent that sells the product. You cannot apply for majority of burial insurance products on your own. |

| 2. Answer Health Questions & Provide Your Prescriptions | You must answer the health questions on the burial insurance application & provide your medications. The Life Insurance company will look at the Medical Information Bureau Health Report and run a Script Check on you using your Social Security Number provided on the application. This allows them to asses your risk and determine if they will approve you. |

| 3. Provide the Name of your Doctor | The life insurance company will want to know the name of your doctor. In most cases they will never contact your doctor however, in some rare cases they can depending on what is found in the MIB reports. |

| 4. Electronically Sign your Life Insurance Application | When applying for burial insurance online you will sign for your application using an electronic signature. Depending on the company you apply it will be a voice signature, e-mail signature or Text message signature. |

| Instant Decision of Approval or Denial | Burial insurance does not require a medical exam which means when you submit your application to the life insurance company it is the last step. Depending on which company you applied with you will receive an instant decision on your application. Some companies or situations may take a few days for a decision. |

Our other Articles on Burial Insurance for Seniors Age 71 – 79

We have covered burial insurance for seniors over 70 at each individual age. Click any of the links below to read more.

Is this Insurance the Best option for Seniors?

In short yes it is, the best reason being is that carriers like ours have an A rating or better.

Now obtaining a rating like that does not happen overnight it is obtained over doing great business with happy customers over a long period of time.

Burial insurance for seniors over 70 will pay for everything related to expenses from a loved ones death. It will cover the burial plot and any left over debts like credit cards or medical bills.

Also, our carriers have a long-standing track record of paying a death benefit within 24 – 48 hours of receiving a death certificate.

So your family will receive this payout quickly and be able to make the funeral arrangements.

No owing the funeral home money or trying to find a loan!

Some people believe they could set aside money in a separate account instead of buying final expense insurance for seniors over 70 for when that inevitable day comes. The truth is:

- That Day is unexpected!

- Even if you build the account to that level it can take 2-4 weeks for it to payout!

Funeral homes are not known for waiting on money. That is why a policy with a quick payout is always the best option especially for seniors on a fixed income.

So when it comes to funeral insurance for seniors and especially funeral insurance for seniors over 70, this program is perfect.

Does this insurance have a waiting period?

In short, no unless your health is extremely poor this is a factor for final expense insurance for seniors over 70.

We pride ourselves on our high level of training, our agents are trained to know all the in’s and out’s of these companies to get someone with what may not be the greatest of health day one level coverage and if not a graded or modified benefit, the bottom line is ACCEPTANCE IS GUARANTEED!

For Example:

Our training tells us that John age 70 COPD diagnosed over 2 years ago that just has a prescribed nebulizer and no other health issues can be approved for day one level coverage.

Not all companies will approve this case for over 70s life insurance but certain companies that we work with a will and that would be exactly where our agents would place you or your loved one.

Now our training also tells us Susan age 70 with COPD and an amputated leg from diabetes from 2 years ago with a few more health issues would be accepted just into a guaranteed issue policy with a 2-year limited benefits period.

In the 1st year typically if death occurs the beneficiary will receive the premiums paid into the policy plus 10% depending on the company which is still an excellent benefit!

Again acceptance is guaranteed.

Does this insurance require a medical exam?

No there is no exam required for burial insurance for seniors over 70 just a few health questions either on a health interview over the phone with the carrier or just on the application with a voice signature.

These are simplified issue plans which makes applying fast and approval within minutes for final expense insurance for seniors over 70!

We see clients all the time asking about life insurance for seniors over 70 no medical exam because in the past they have taken one for past policies most notably term policies.

Can an agency help me with purchasing life insurance for myself or a family member?

Absolutely! The family member you are purchasing the policy for would have to be present with you for a voice signature at the time of applying.

If you are purchasing for just yourself it would just be a quick voice signature.

Here’s how the process works:

Fill out the form to your right and you will receive a call from one of our agents and they would confirm some basic information as well as confirm the health conditions for you or your loved one.

Then our agent would do a 3-way call with you and the carrier for voice signature or depending on the carrier just do a quick voice signature and receive confirmation and approval in minutes.

The form to your right will show you how much life insurance for a 70 year old would be with top A-rated carriers.

FAQ

Can you be denied burial insurance?

Yes, you can be denied life insurance for final expenses. That being said you can still apply for guaranteed issue life insurance if your health conditions are extremely severe.

How much does life insurance cost for a 70 year old?

It would depend on age, health, and geographical location to get an exact price but a ballpark figure would be for $10,000 – $20,000 around $70 – $100 monthly.

Is cremation cheaper than burial?

Yes in most cases across the board cremation is more affordable.

Who is burial insurance for?

Burial Insurance is largely for seniors on a low or fixed income but is available for everyone.

Final Expense Insurance for Seniors over 70 Coverage Amounts & Additional Benefits

Picking your coverage amount depends on what your ultimate goal is for protecting your family. If you just want to make sure a burial is covered you would want to get a $15,000 death benefit policy.

Now if you want to make sure a burial is covered and leave behind an extra cushion for your family we recommend getting the maximum senior benefits of $30,000 – $40,000.

This is why this type of funeral insurance for over 70 is so beneficial.

It fills different needs instead of a “one size fits all” approach.

In addition to this many burial life insurance for seniors over 70 policies have extra policy riders that can be included as well.

These can add additional accidental coverage or living benefits to your policy. Policy riders are great for burial insurance for seniors over 70.

A highlight of this is the Automatic Premium Loan Provision.

The automatic premium loan provision is designed to pay your premiums for you with the cash value of your policy if you become disabled or terminally ill.

Life Insurance for Parents Over 70 Pricing

We get clients on a daily basis wanting to help their parents get coverage. This is why we specialize in burial insurance for seniors over 70 and have helped many young adults get their parents covered.

When it comes to life insurance over 70 pricing it can vary depending on your parent’s health, lifestyle, and gender for funeral policies for over 70.

In most cases, a female’s rates would be cheaper than a male’s rates because females are known to live longer.

Pretty tough break if you are a male looking for funeral policies for over 70 huh? Now your health is also a factor if you have moderate health conditions that may increase your rate.

This is something one of our agents would go over with you about your parents at the time of their application. Again the 2 most notable factors are age and health.

This is why it is crucial to work with an independant agency that specializes in burial insurance for seniors over 70.

This guarantees you will be protected from your parent’s final expenses and get the best life insurance rates available for funeral policies for over 70 to them.

For example’s sake life insurance for 70 year old man in perfect health for $10,000 with Greek Catholic Union would be $70.88 a month.

That would be the price for one of our top rated carriers if they can qualify for life insurance for 70 year old male.

We have a few more example rates below.

For a more accurate quote and to see what they qualify for fill out the form to your right.